By: Colin Jessup

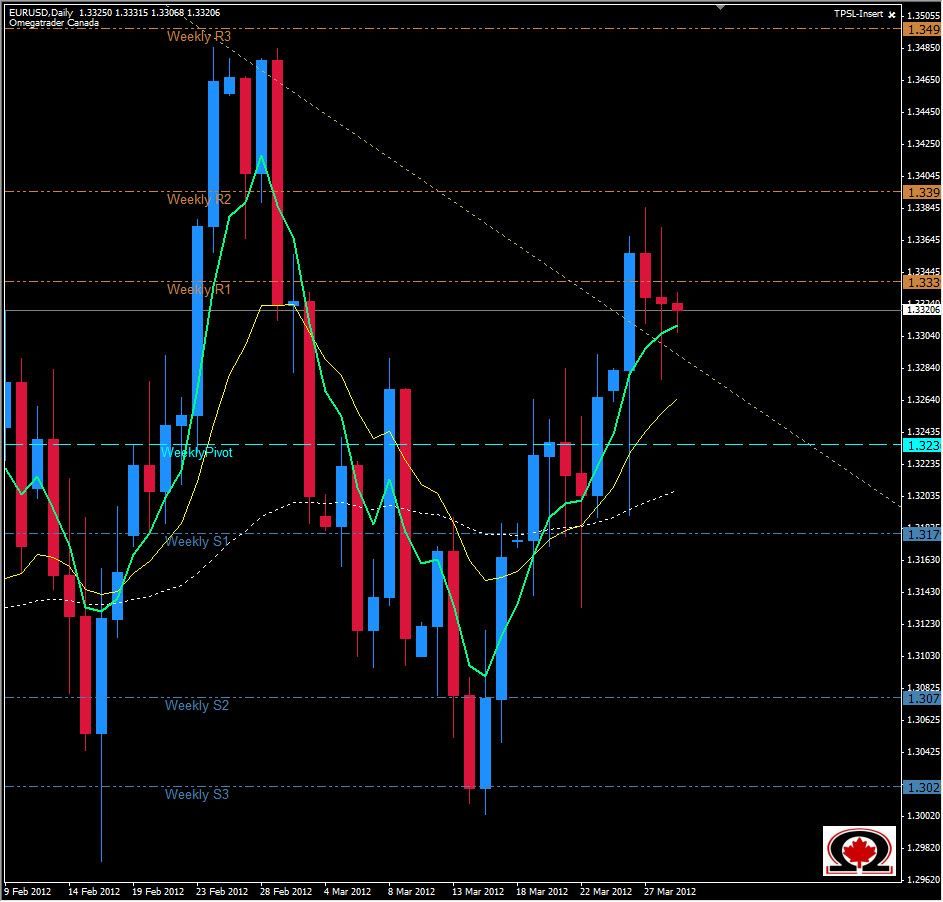

The EUR/USD has breached a descending trend line that began at the high of August 28, 2011, but has only just closed outside this form of resistance on a daily chart, and has pulled back. There is heavy resistance of other forms at this level also, such as the Monthly Pivot at 1.3260, a Weekly S/R zone stretching as far back as 1992 and numerous other stopping points along the way. The EUR/USD has been trading in a descending channel since closing below 1.4050 in September 2011 making a series of lower highs and higher lows with the current price action possibly falling into the new lower high category if it cannot break resistance. In order to confirm a Bullish Breakout of this channel we will need to clear 1.3338 which is the current Weekly R1 and possibly even 1.3400 to be sure. If we close back below 1.3230 it is possible we will see a new lower low in the 1.2100 level before the end of the year. From an intra-day perspective, we seem to have more pressure from the bears than bulls, even though we are currently trading higher than the week opened. The key level today will be the Daily Pivot at 1.3320 and Daily S1 at 1.3270.

Interesting Fact: The "paper" used for Euro banknotes is in fact 100% pure cotton "fiber", which improves their durability as well as imparting a distinctive feel. This is why the EURO is sometimes referred to as Fiber among traders.