By: Colin Jessup

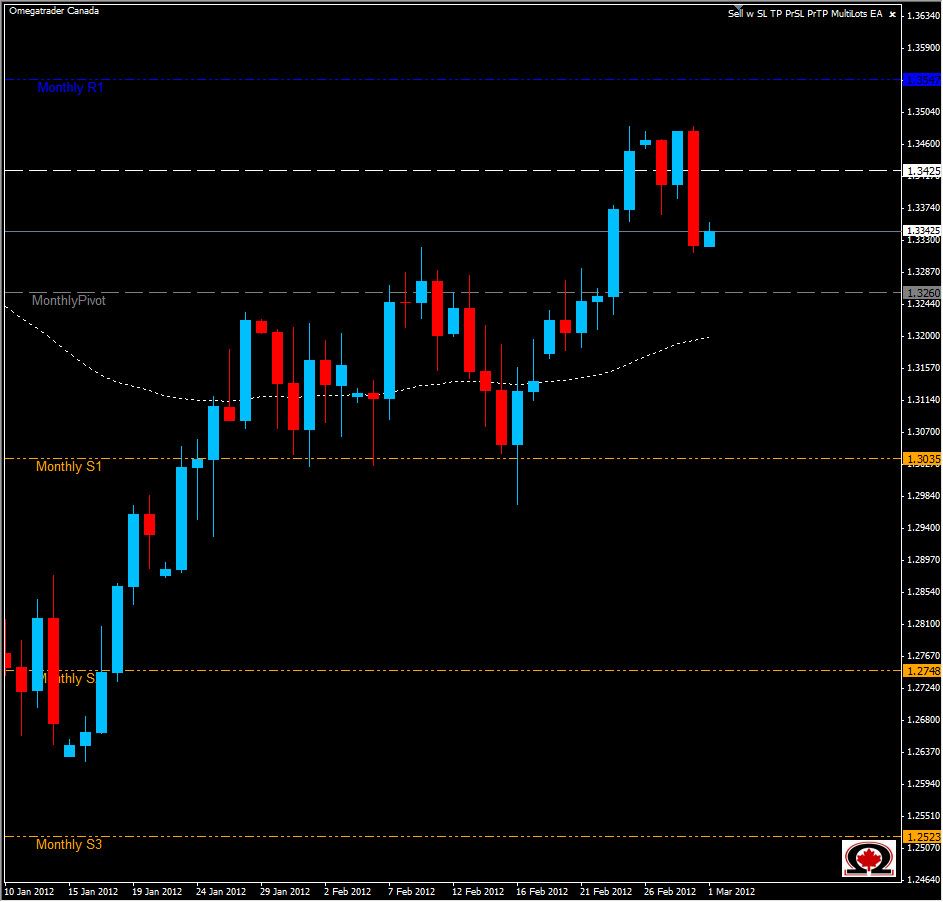

The EUR/USD fell 171 pips on the last day of trading in February, fitting for a leap year in that it was like the bears leapt off a cliff that was the high for the past several days at 1.3478. After trading for several days between 1.3365 & 1.3478 and a breakout was imminent and the pair did not disappoint after the ECB released its refinancing results. The market is slightly bullish at time of writing approximately 1 hour before the London open. If we continue the bearish momentum, look for daily support at 1.3263 and 1.3200 below that. To the upside, the Bulls will need to clear the daily pivot at 1.3373 and the daily R1 at 1.3430. There is a strong possibility that the pair will fall to the 1.3250 level before finding some support. We have some key information coming out today with PMI and unemployment numbers releasing.