By: Colin Jessup

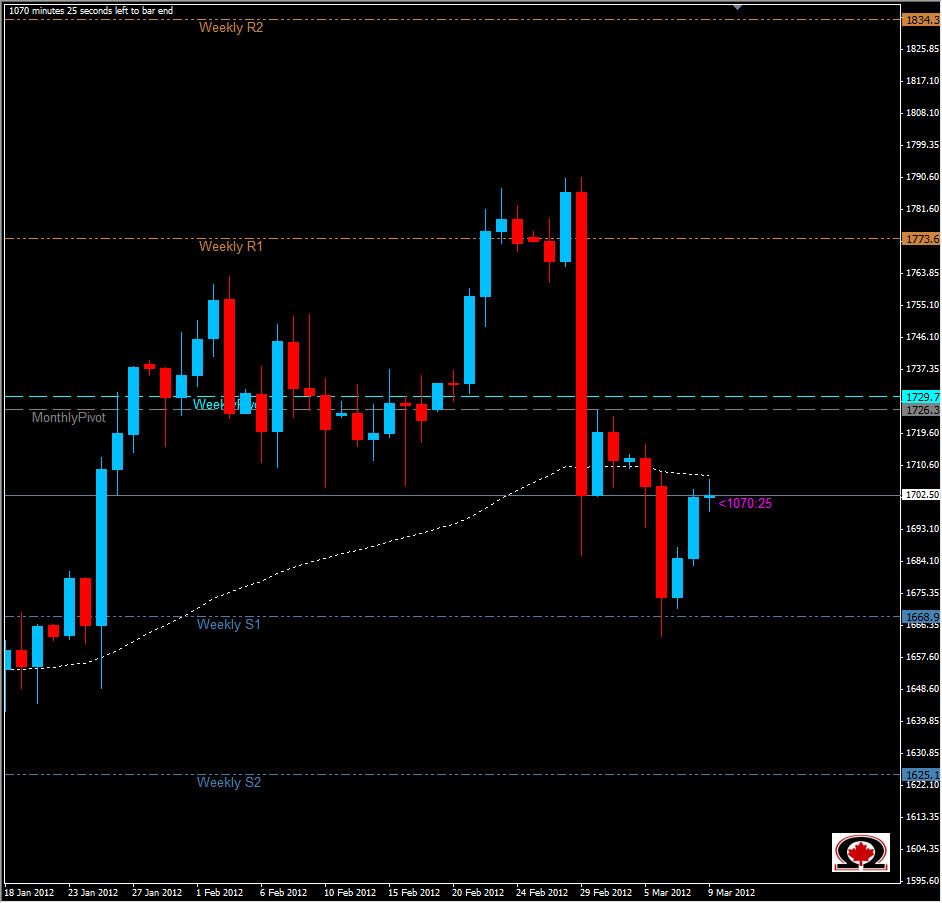

Gold vs The Greenback (or XAU/USD) has again turned Bullish after falling almost 13,000 Pips since hitting a 3 month high on February 29 at 1790.50. Bottoming out this week at 1662.50 the pair came to a stop on the Weekly S1 of 1670.2, also the 50% retracement level, and has since worked its way back up to just below the 62 day moving average at 1707.92.

The Greenback has been weaker against most currencies and commodities including Gold due to less than positive unemployment numbers out of the USA and hopes regarding Greece's debt restructuring bringing investors back to the Euro in droves. With less than 18 hours remaining in the trading week, the Weekly chart is printing a slightly bearish hammer formation off of the Weekly S1, an potential indication of higher prices to follow.

If price closes above 1707 we could potentially see a run for the 3 month high once again before month end, but the highly sought after commodity will have resistance to fight through at 1709, 1716 and the Weekly Pivot at 1730 first. Should the USD recover from its unemployment number wounds the pair could once again turn bearish and encounter support at 1696, 1688 and 1675 on its way down to re-test the 3 month low.