Trades placed by optionFair

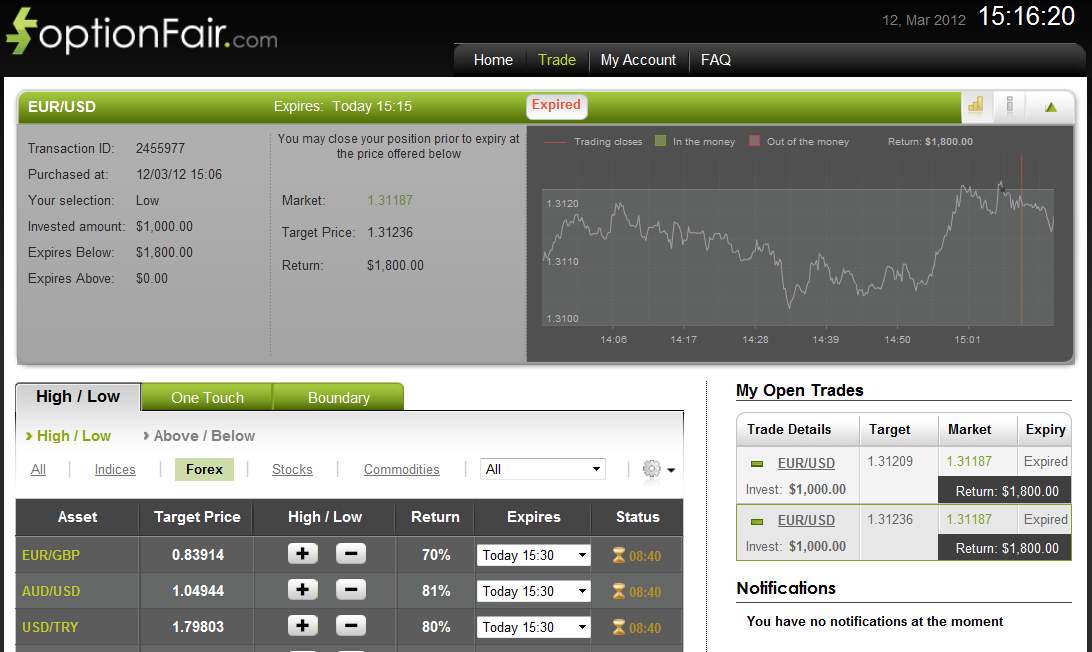

EUR/USD

Based on Colin Jessup‘s analysis of the EUR/USD. The EUR is attemping a drop. This behaviour creates an investment opportunity in the following positions: “Low” or “Below”, “ No Touch” or “ Touch Down” on the EUR/USD. With optionFair™ Binary Options Trading Platform, I traded with $1,000 on the “Low” instrument.

This kind of option has a return of 80% if the option expires below the strike price at expiry time. I could get a return of $850 on my investment. The market price for EUR/USD at the buying time (15:06) was 1.31236. At the expiry time (15:15) the market price was 1.31187 which is below my Strike, and I won 800$ in only 9 minutes.

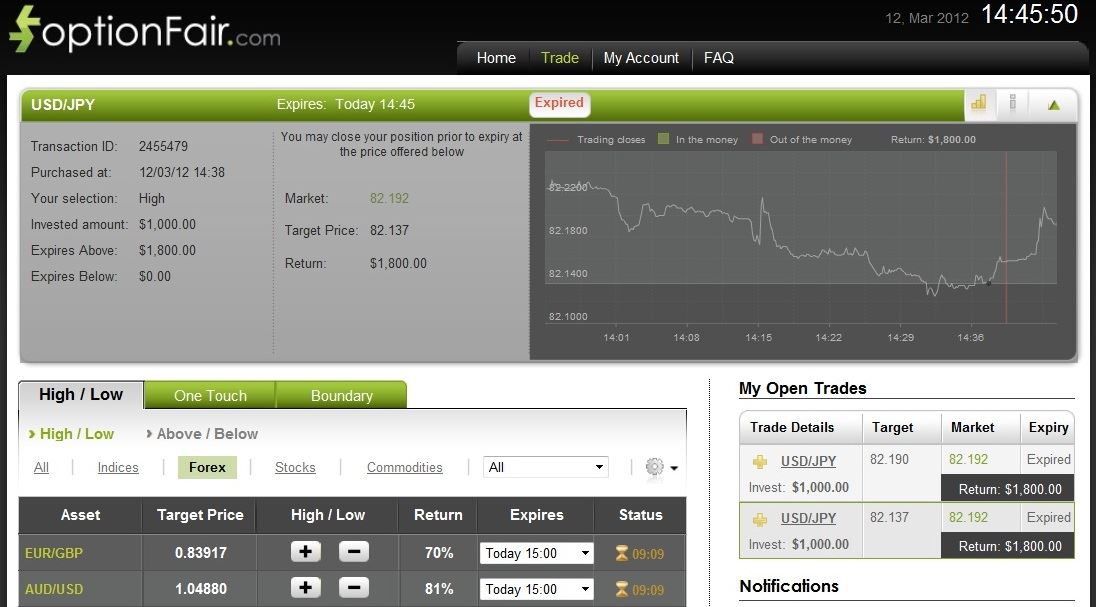

USD/JPY

Based on Christopher Lewis‘s analysis of the USD/JPY this pair continues to remain bullish or upward-moving. A bull market is associated with increasing investor confidence, and increased investing in anticipation of future price increases (capital gains). A bullish trend in the stock market often begins before the general economy shows clear signs of recovery. This makes an interesting opportunity on the “High” instrument.

I logged in the optionFair™ Binary Options Trading Platform when the market price for the USD/JPY at 14:38 was 82.137 . I decided to place $1,000 on the “High” instrument.

This kind of option has a return of 80% if the option expires above the strike price at expiry time, which means I’ll earn $800 on my investment. At the expiry time (14:45) the market price was 82.192, which is above my strike and I won in only 7 minutes.