Trades Placed by optionFair

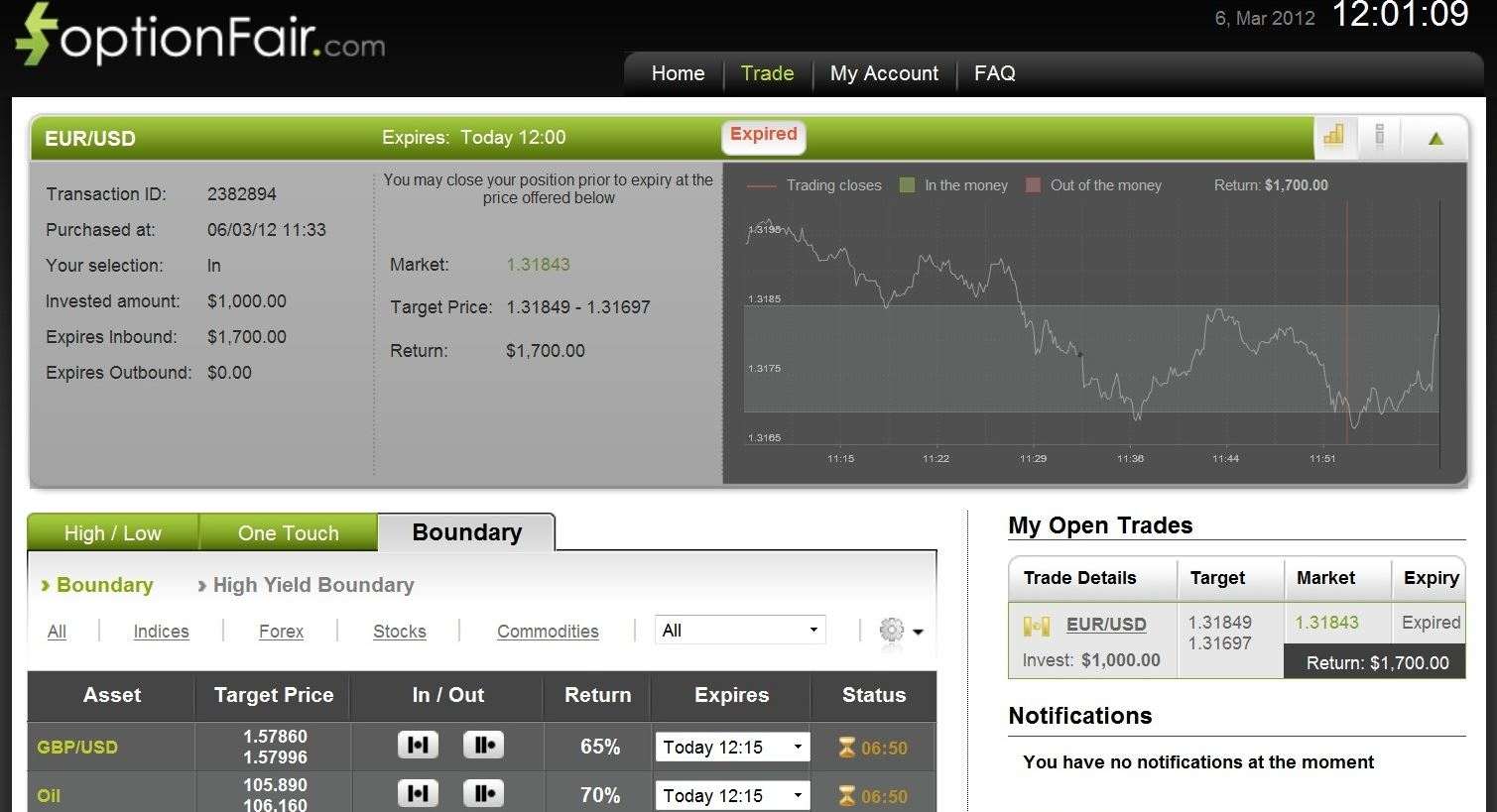

EUR/USD

Based on Christopher’s analysis of the EUR/USD, the volatility of this pair is very low. Volatility refers to the amount of uncertainty or risk about the size of changes in a security's value. A lower volatility means that a security's value does not fluctuate dramatically, but changes in value at a steady pace over a period of time.

One measure of the relative volatility of a particular stock to the market is its beta. A beta approximates the overall volatility of a security's returns against the returns of a relevant benchmark (usually the S&P 500 is used). For example, a stock with a beta value of 1.2 has historically moved 120% for every 100% move in the benchmark, based on price level. Conversely, a stock with a beta of .9 has historically moved 90% for every 100% move in the underlying index.

That creates an opportunity on the instruments: "No Touch Down", ”No Touch” and “In”.

I logged into the optionFair™ Binary Options Trading Platform and I traded with $1,000 on the “In” instrument. This kind of option has a return of 70% if the option will expire in the boundary, which means that if the signal is correct, I could get a return of $700 on my investment.

The market price for EUR/USD at the buying time (11:33) was 1.3177 and the boundary I got was 1.31697-1.31849. The EUR/ USD price stayed inside the boundary and the market price at the expiry time 12:00 was 1.31843 and I won the position and earned $700.

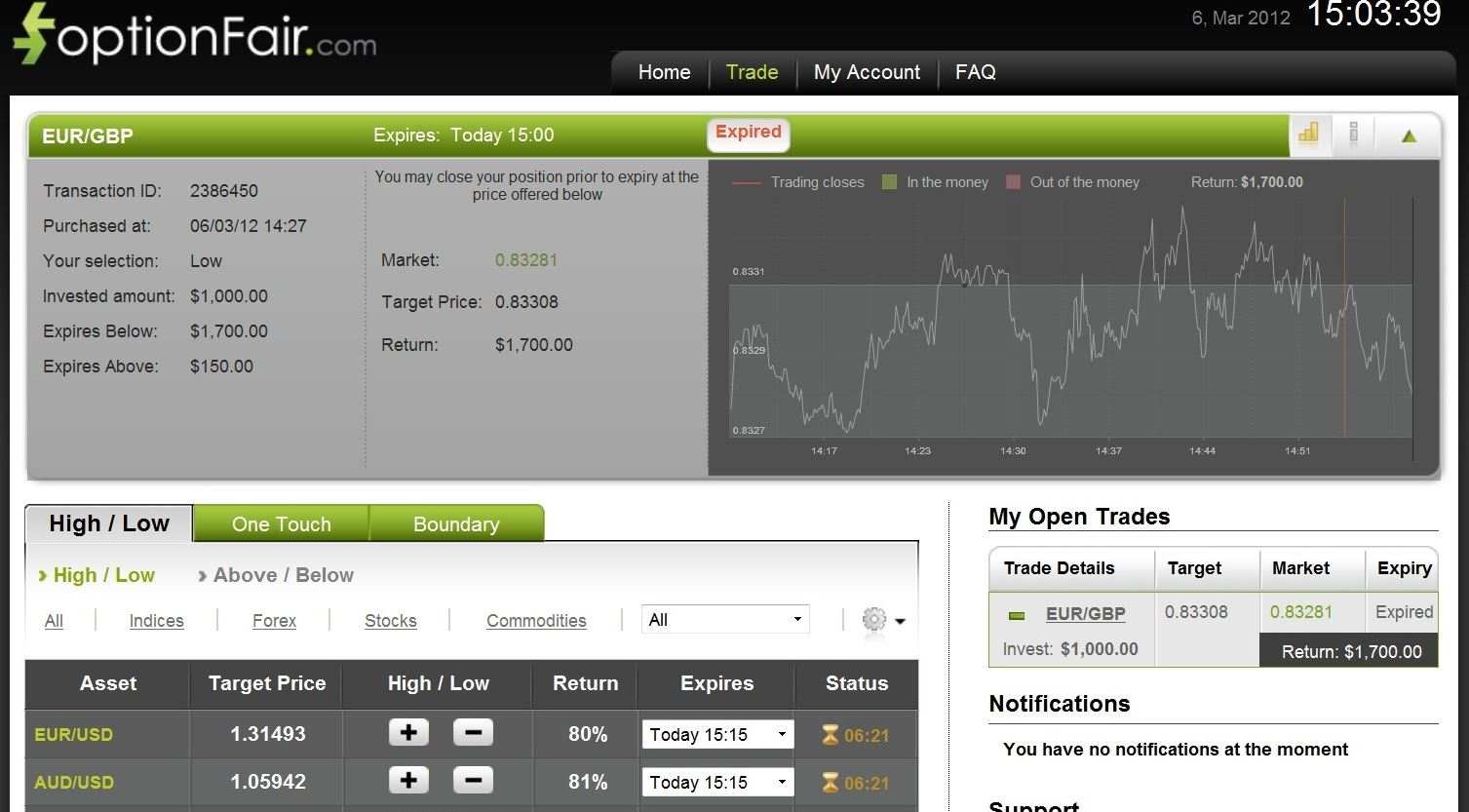

EUR/GBP

Based on today's analysis, the EUR/GBP is showing bearish signs. The instrument I can use in this scenario is: "Low". Bearish behavior is believing that a particular security, a sector, or the overall market is about to fall.

With optionFair™ Binary Options Trading Platform, I traded $1,000 on the “Low” instrument. This kind of option has a return of 70% if the option expires below the strike price.

That means that if the signal is correct, I could get a return of $700 on my investment. The market price for the EUR/GBP at the buying time (14:27) was 0.83308. The expiration took place at 15:00 at the price of 0.83281, below the strike price which earned me 70% on my $1,000 investment.