By: Christopher Lewis

USD/CAD has been a choppy pair to trade lately. Most of the traders that I know who are enjoying it at the moment are short-term traders, or even scalpers by mature. The pair has a long history of chopping around, only to suddenly move quickly in one direction or another. The pair will often follow the oil markets, but in inverse as the Canadian dollar is heavily influenced by the cost of Canada’s highly regarded oil exports.

The other thing that tends to get this pair sideways is the simple fact that the two economies are so interconnected. The US is Canada’s #1 export market, and as such the health of the US is also the health of most of Canada’s customer base. (The US is roughly 80% of the market for Canadian goods.) So naturally when the customer down south is broke – there isn’t going to be a large amount of sales. In other words, the economies can’t outrun each other for too long.

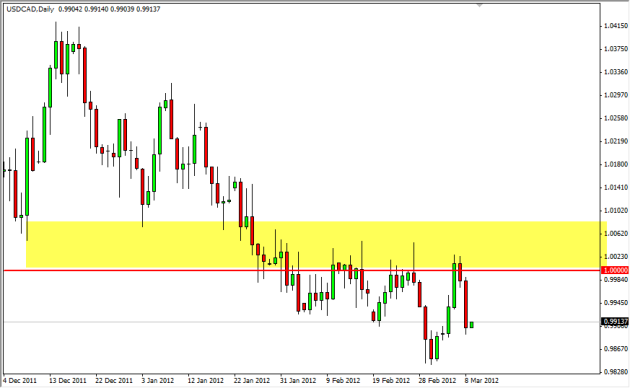

Parity, 0.99, 0.98, 0.9750, and 0.97 – that’s all….

So looking at this pair, I have recently found it difficult to trade for many reasons. The most obvious one is the simple lack of free space in order for the pair to move. In other words, the support and resistance areas are far too close to each other in order to make trading it simple. If you are a short-term trader, this is possible – but for someone like myself who prefers the daily charts, there simply isn’t any room to work with.

The parity level is an obvious level, and I believe it goes all the way up to the 1.01 handle. I think of this as one “thick zone” of resistance, and as such I need to see the market close above 1.01 in order to buy this pair. The downside looks very protected by the 0.99, 0.98, 0.9750, and 0.97 levels for support. With this in mind – I am waiting to see the 0.97 level broken and in our rearview mirrors before I am short of this pair.

This could happen quickly though as Non-Farm Payrolls will be reflected in this pair. Ironically, if it is a good number – the pair falls…….mainly because of the idea of “expansion” in the US means more Canadian goods being bought.