By: Colin Jessup

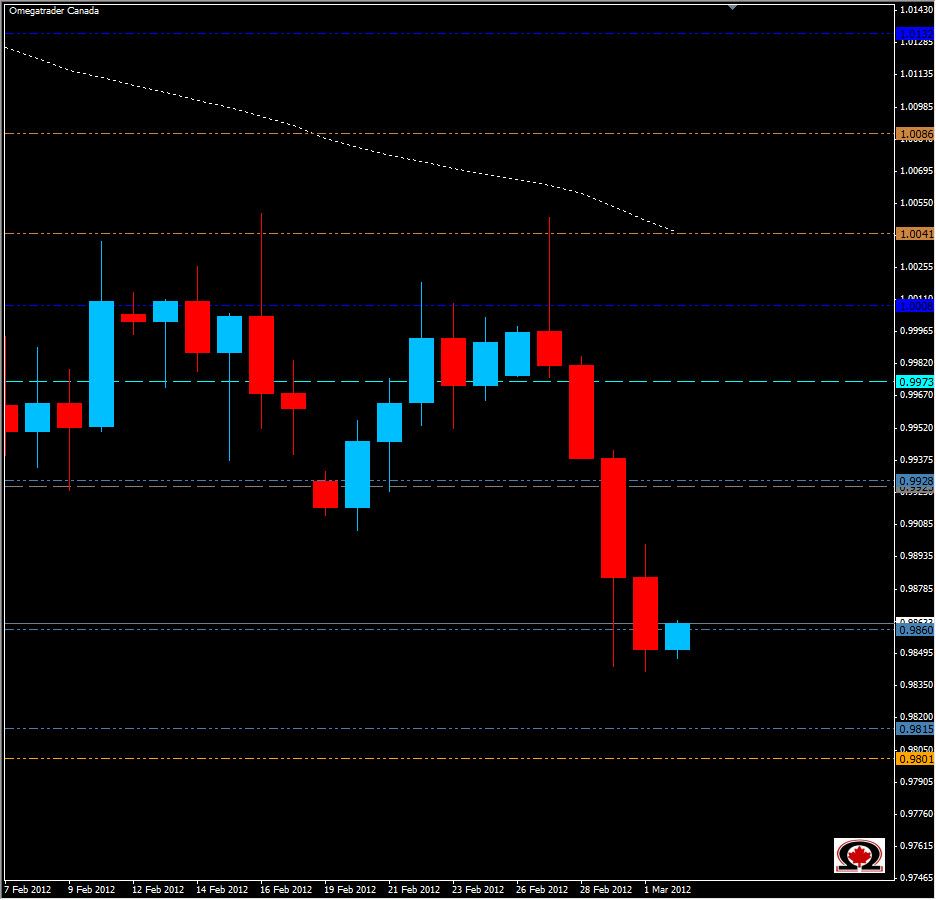

The USD/CAD daily chart has been tumbling since the start of the week when the greenback pushed as high as 1.00485 against its norther cousin, the Canadian Loonie. Since then, thanks to economic factors in the USA and rising oil prices, the Canadian dollar is rising in value against the Greenback, and pushing the chart price lower. Price has now cleared a weekly support level at0.9860 and will most likely reach the 0.9800 level very soon. On the way down the pair will encounter more support at at 0.9828 & 0.9815 while the upside will see resistance at the Daily Pivot level of 0.9863, Daily R1 at 0.9886 and beyond that there is a small technical vacuum until 0.9922. While some retracement is possible, this pair is strongly bearish and will probably continue, especially with no economic news scheduled for the USA and Canada's official GDP numbers being released at 13:30 GMT. Canada's economy continues to grow slowly but surely, thanks to a growing technical sector and of course OIL. I am strongly bearish in the USD/CAD.