By: Christopher Lewis

The USD/CHF pair has been rising quite a bit lately, and this will without a doubt draw suspicion out of many traders out there. The trend on all larger timeframes shows that this trade has been one-way for ages, and as a result moves like we have seen lately are very rarely trusted at first.

A trend change is a funny thing. Most Forex traders aren’t involved in the markets long enough to see a true long-term trend change, as they tend to come around every 3-5 years. The fact is that many traders are only in the markets for a handful of months before blowing up their accounts, and as such simply don’t see these things happen in real time on the whole. Sure, it is one thing to look at a move from 10 years ago and say “Man! I would have sold that pair and rode it all the way down!!!” However, actually doing it is an entirely different animal altogether.

The importance of confluence

The trend change case is a hard one to make most of the time. However, every once in a while you have so many things lining up at once that it just makes sense. In this pair, there are many different things happening at one time, and as such – I feel this pair is going much, much higher over time.

The European Union is the destination of over 80% of Switzerland’s exports. They will be trying to export to a region that on the whole will be in recession and with a strong Franc on top of that. This is very damaging to the Swiss economy, and as a result it is hard to think it will stand up to the US economy as it is actually growing.

The Swiss National Bank has put in a “minimum acceptable rate” in the EUR/CHF at the 1.20 handle. This is for the reason listed above, and as a result the pair has been fairly stagnant. It is currently sitting just above that area, and if we get a sudden rush into the Franc – the SNB will intervene, and that will affect this pair as well, and traders know this. Although not a direct threat, it is a treat to the bears none the less.

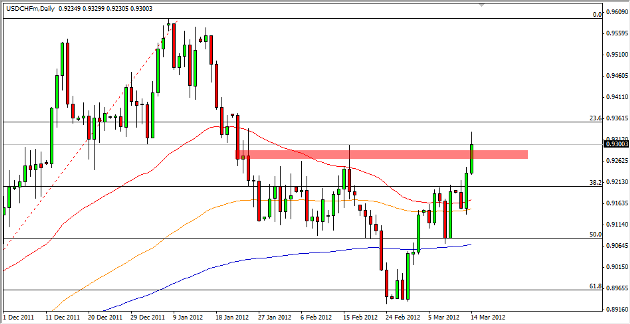

On the technical side, we have the 50, 100, and 200 day EMAs all pointing north at the same time. This was actually the result of a crossover back in November. The trend traders would now call this a bullish reversal. Also, the 61.8% Fibonacci of the recent rise in price held the pair up, and served as support. The 0.90 level was just above it, and it appears the confluence of all of these factors was enough to get people involved.

Also, the US dollar is the ultimate safety trade. If things get bad, they will run to the Dollar as well. In other words, there are reasons to own the pair in either good or bad times. The break above the 0.9250 resistance level on Wednesday also shows another resistance level giving way. I am buying (actually adding to an existing position) on a break of the Wednesday high.