By: Colin Jessup

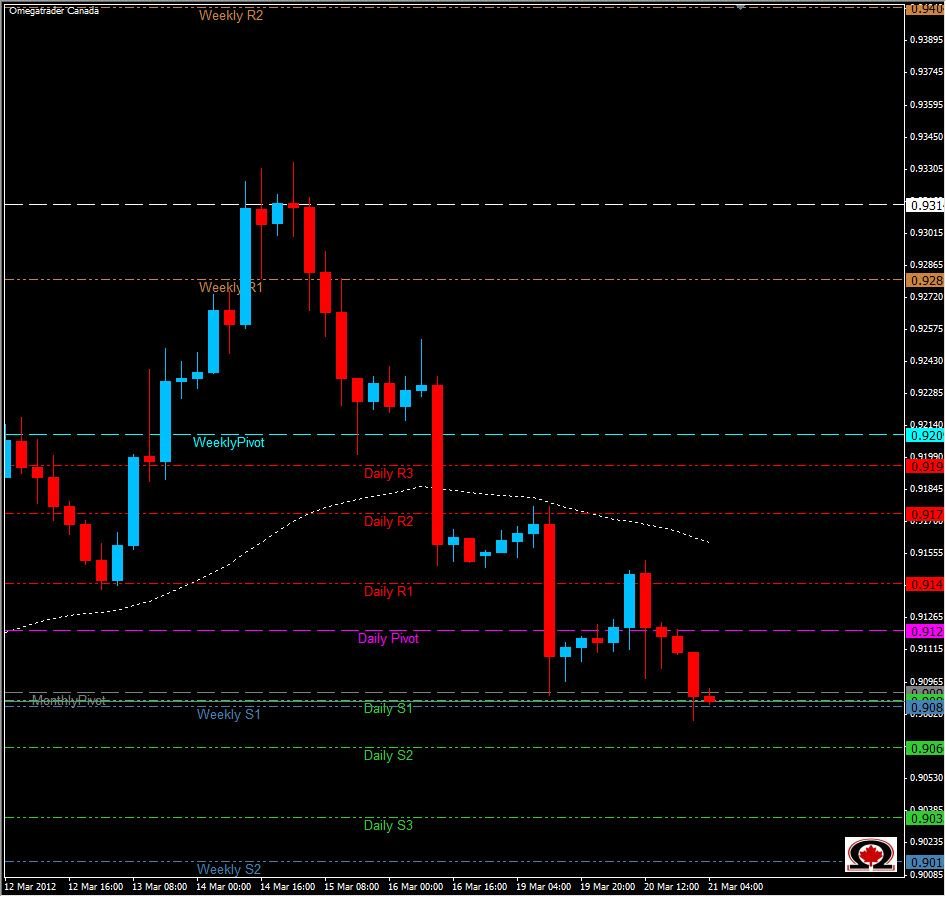

The Swiss Franc is extending its gains on the American Greenback, but has hit a snag in the hours leading up to the London Open. Currently trading at 0.9087 the pair is stuck in between the Daily S1 at 0.90884 and Weekly S1 at 0.90855. Price has broken below both levels trading as low as 0.9079 before pulling back to retest the Monthly Pivot at 0.9092 twice during Asian Trading, and falling each time. This marks the 5th straight day of Bearish trading since trading as high as 0.93338 on March 15. The pair has its work cut out for it with heavy support from Daily & Weekly levels directly below such as the Daily S2 at 0.90668 and Daily S3 at 0.90350, plus Weekly S2 at 0.9015. Above 0.9009 we have the Daily Pivot at 0.9120, DR1 at 0.9142 and DR2 0.9174, not to mention the Daily Moving Average to tackle at 0.9169. So while this pair seems bent on continuing lower, there are many levels below that will do the absolute best to slow it down, and could force a pull back to once or more of these levels in order for the Bears to rally further.