By: Colin Jessup

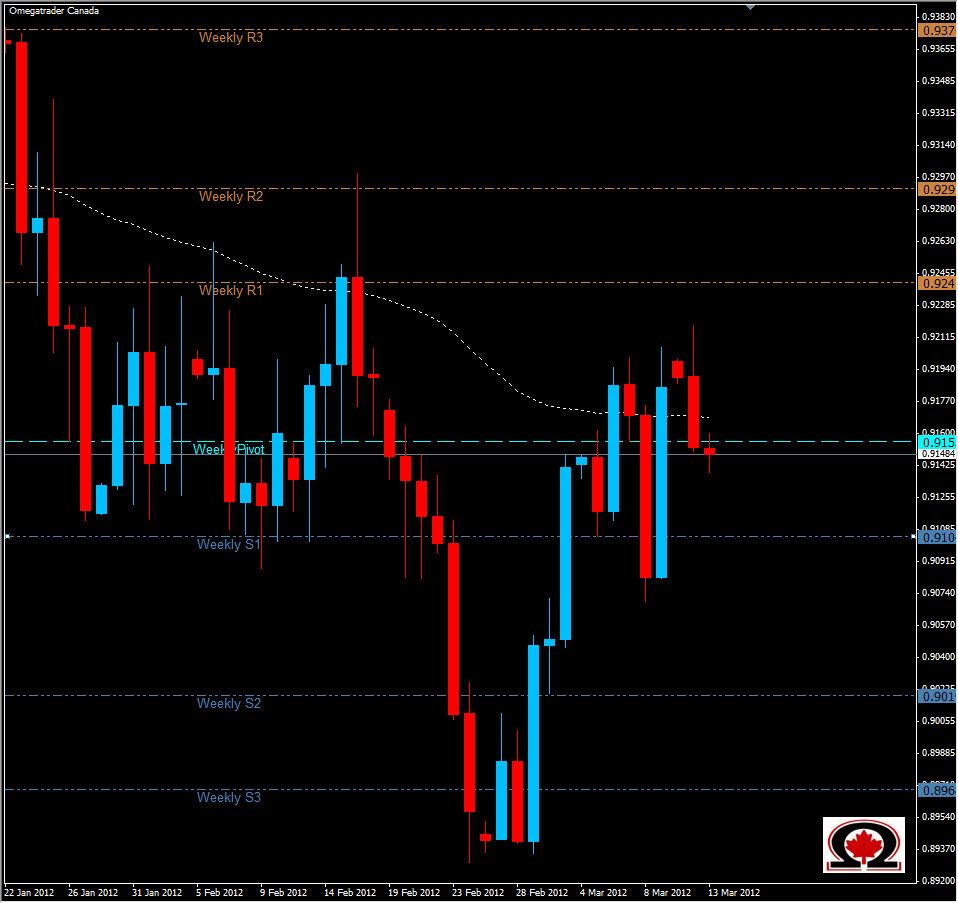

The Greenback fell against the Swiss franc today, pulling back on the daily chart to the weekly pivot point, and the same zone that has held the pair in its grip for most of February and has flirted with for all of March. After last week's see-saw action, this could be a last kiss scenario, where price pulls back to mean and then bounces. However, with a close below the Daily Moving Average once again, this pair should be classed as Bearish except that the same moving average is almost perfectly horizontal indicating a clearly sideways market. If price does continue lower, we will see support zones at 0.9120, 0.9100 & a Weekly Pivot at 0.909 so the Bears have their work cut out for them. To the upside, we see resistance at 0.9150, 09170 and 0.9190...but above 0.9200 we have a pretty clear shot up to the Weekly R1 at 0.9240. I personally would like to see a close either above 0.9290 or below 0.9000 with volume behind it to pull us out of this sideways action. I am neutral on this pair in the interim.