By: Christopher Lewis

EUR/USD

The EUR/USD pair had another bearish week over the last 5 sessions as the Greek drama continues to unfold. The country was finally made to be in default in the CDS markets. The pair will continue to be weighed upon by various headwinds as the world continues to trade the headlines in this pair. The candle was a shooting star at the bottom of a fall, but there is a certain amount of support down to the 1.30 level. The most likely reaction is going to be a bit of a bounce, followed by weakness later in the week. The 1.29 level is absolutely vital for the bears to overcome if they are to seriously push this pair down.

AUD/USD

The AUD/USD fell during the previous week, but managed a bit of a bounce from the 1.05 handle. The pair continues to be constructive, and the 1.04 is my line in the sand when it comes to this pair. The recent consolidation was fairly strong, but the trend is clearly up, and the 10.8 level has been broken before. This week should see strength in this pair.

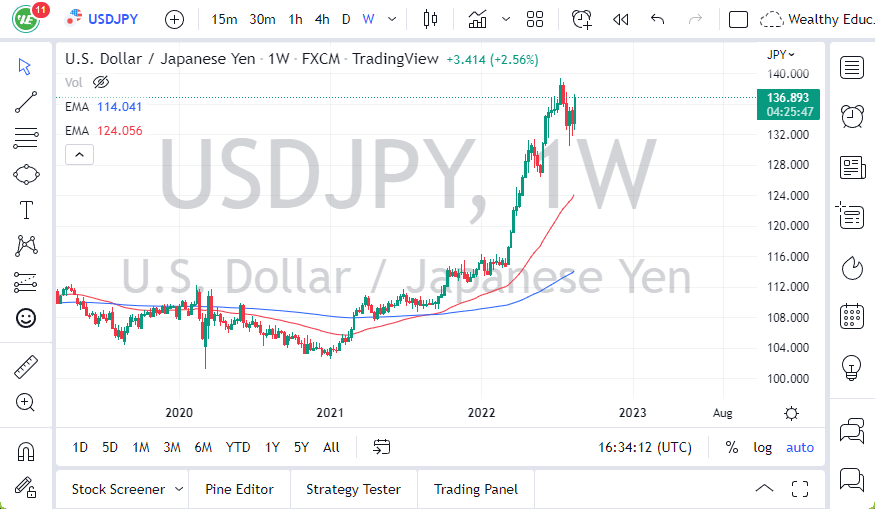

USD/JPY

USD/JPY fell at first over the previous week, but like the one before it – the pair managed a strong bounce in the late part of the week to form a hammer-like candle. The Bank of Japan is flooding the markets with Yen by buying the JGBs in the bond markets, and this should continue to pressure the Yen overall, pushing this pair higher. Dips are to be bought going forward.

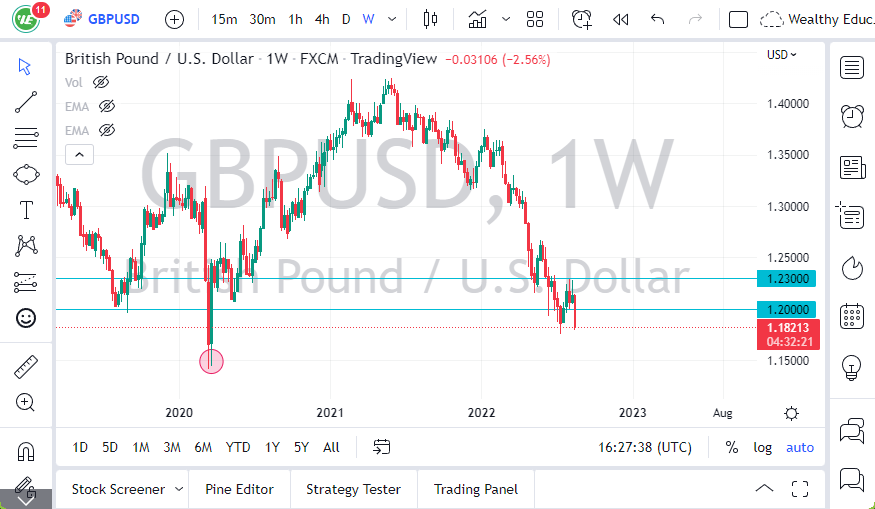

GBP/USD

The cable pair fell hard for the week after forming a shooting star the week before. The fall would have triggered sell stops, and now we find the pair testing the 1.5650 level for support. This level will be vital for the bulls, and if it gives way we will see 1.55 and possibly 1.53 in fairly quick order. The pair falls much farther if 1.53 gives way in the end.

USD/CAD

The USD/CAD pair formed a shooting star, and was rejected at the parity level yet again. However, there is support just below at the 0.99, 0.98, 0.9750, and 0.9700 levels. The oil markets will more than likely continue to support the Loonie, driving this pair lower. However, even with the downward bias, this pair will be choppy at best and difficult to trade in the near term.