By: Christopher Lewis

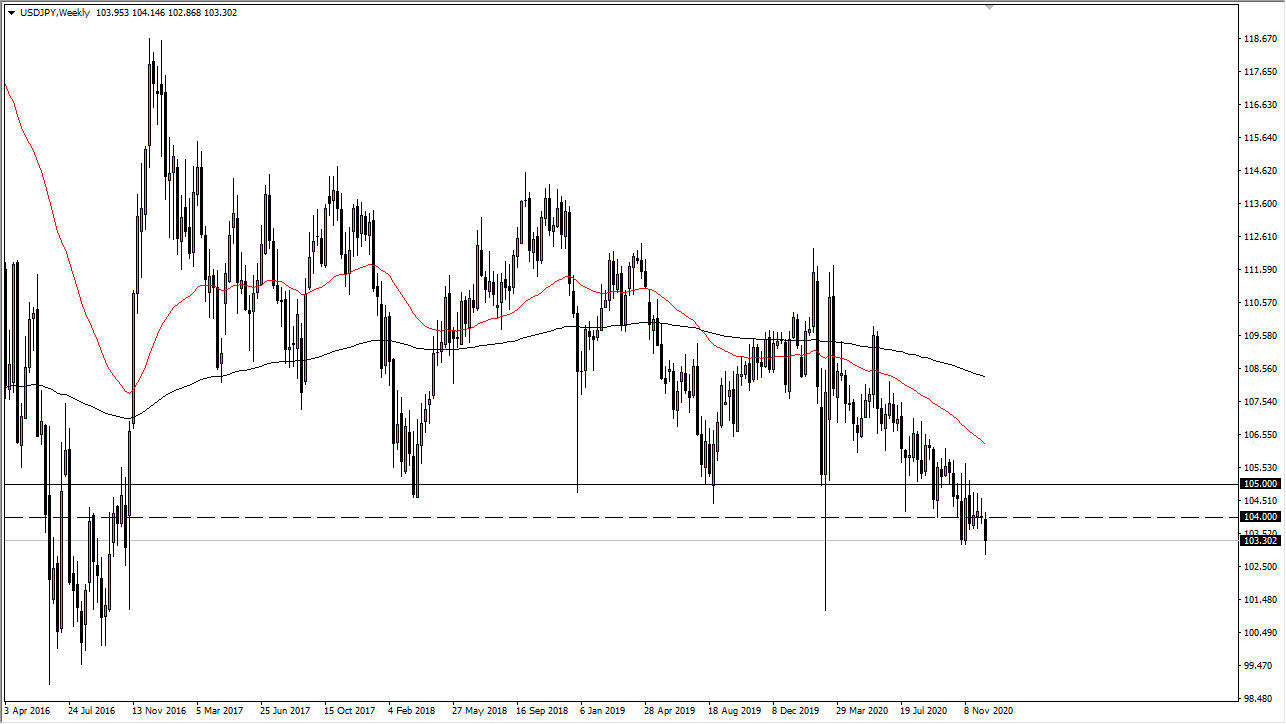

EUR/USD

EUR/USD gave back all of the previous week’s gains in a very bearish week. The pair continues to find the 1.35 level far too resistive to conquer, and as a result it looks as if we are heading back to the 1.30-ish area. The recent action has been headline-driven, and this is probably going to be the case going forward.

The problems facing the European Union continue to plague the markets, with the Spanish announcing that the austerity measures they agreed to wont be met. With this being said, it could be another round of problems for the Euro. However, we have seen how resilient the pair is, so the 1.30 area will more than likely hold over time.

AUD/USD

AUD/USD fell during the week, but is currently grinding sideways overall. After the massive uptrend that the pair has been in, the pair needed time to consolidate in order for the buyers that hadn’t been able to go long earlier. The 1.06 level should continue to hold up as support, but if it doesn’t – the 1.04 level is even more supportive. Between the two areas, support should reappear for the Aussie, and a break of the 1.08 level is more than likely coming. After that, we should see the 1.10 area tested. Currently there is no need to short this pair from where I am looking.

USD/CAD

This pair is a mess overall. The parity level acted as a magnet for price during the recent past. However, we have seen the 0.99 level give way as support, and since then have fallen a bit, only to bounce back up in order to retest the 0.99 level as resistance. However, the pair has many support levels both major and minor going down to the 0.97 handle. This will continue to make down moves choppy, and the pair has resistance at parity and 1.01, which will make buying difficult as well. There are simply far too many areas where price is going to chop around to be bothered with this pair presently.

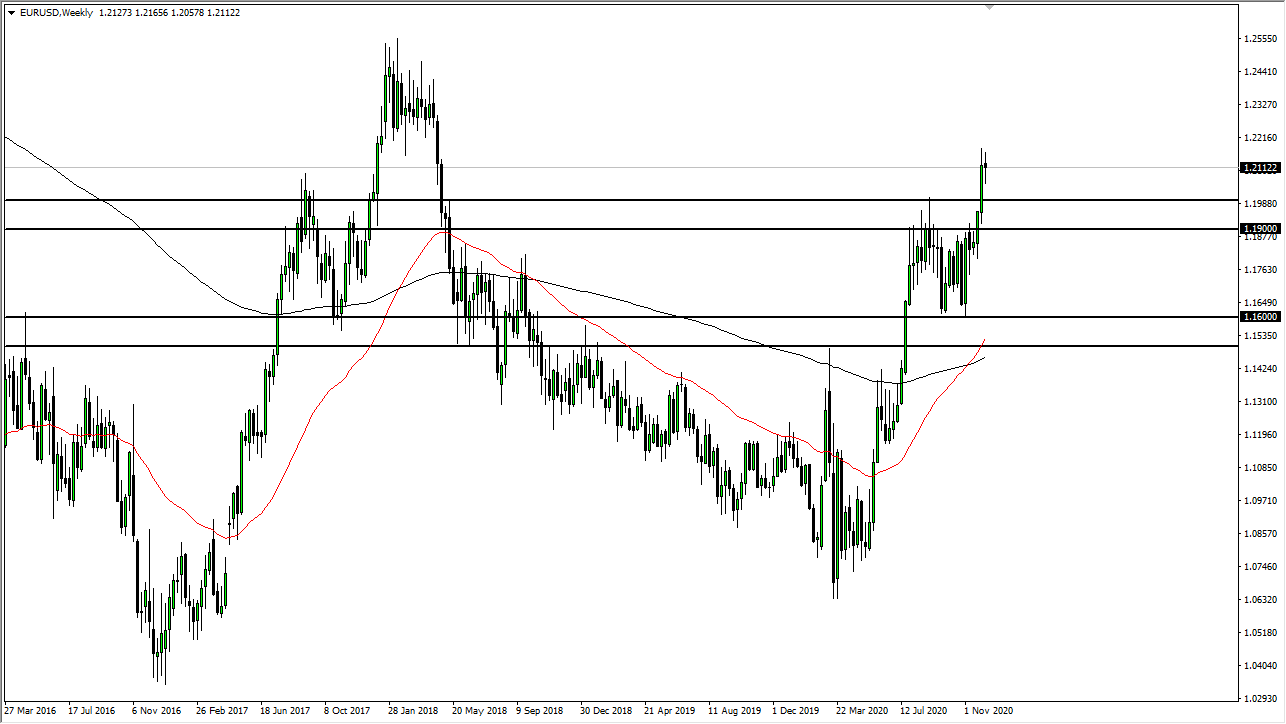

USD/JPY

USD/JPY rose again during the week, but even more impressive is the fact that we have broken above the 80 level, and then fell back to retest it for support. The resulting weekly candle is a hammer on that line, and we have broken the bearish trend line form 2007 that has pushed this pair down to these low levels. Because of this, it is very likely that the trend in this pair is changing. I will buy dips going forward now as long as the 80 level is below us.