By: Colin Jessup

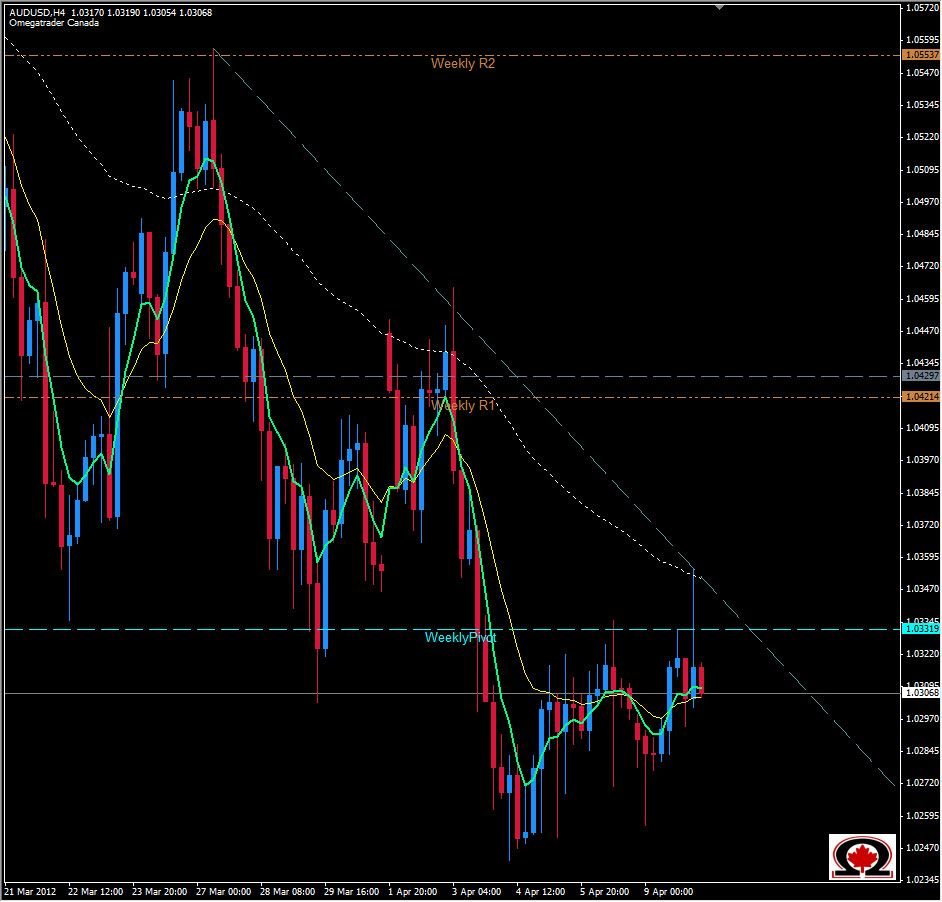

The AUD/USD might be setting up to head lower with the 4-Hour Chart showing us why. The pair has been in a downward channel since February 29 when it hit the high for 2012 so far at 1.0855 and began its decent 48 hours later. Making a series of Lower Highs and Lower Lows, today's high at time of writing lines up perfectly with the upper line of the channel and has printed a 'Pin' bar, or shooting star as it is known to some. Price tried to break out of the channel and above the weekly pivot at 1.0332 but immediately fell back inside and closed lower creating a long wick on the upside. The location of this bar is what makes it so powerful, finding heavy resistance at the historical resistance zone at 1.0354, the top of the descending channel and weekly pivot which all converge within 20 +/- pips, it is no wonder price pulled back. The pair is probably headed for the Weekly S1, also the bottom of the channel, at 1.0199 and possibly 1.0101 beyond that later this week. If price breaks through and closes above 1.04000 we will have broken the channel and could be looking at an all out Bullish reversal once again. The Monthly Pivot is also important above once the channel is broken, which sits at 1.0430.