By: Colin Jessup

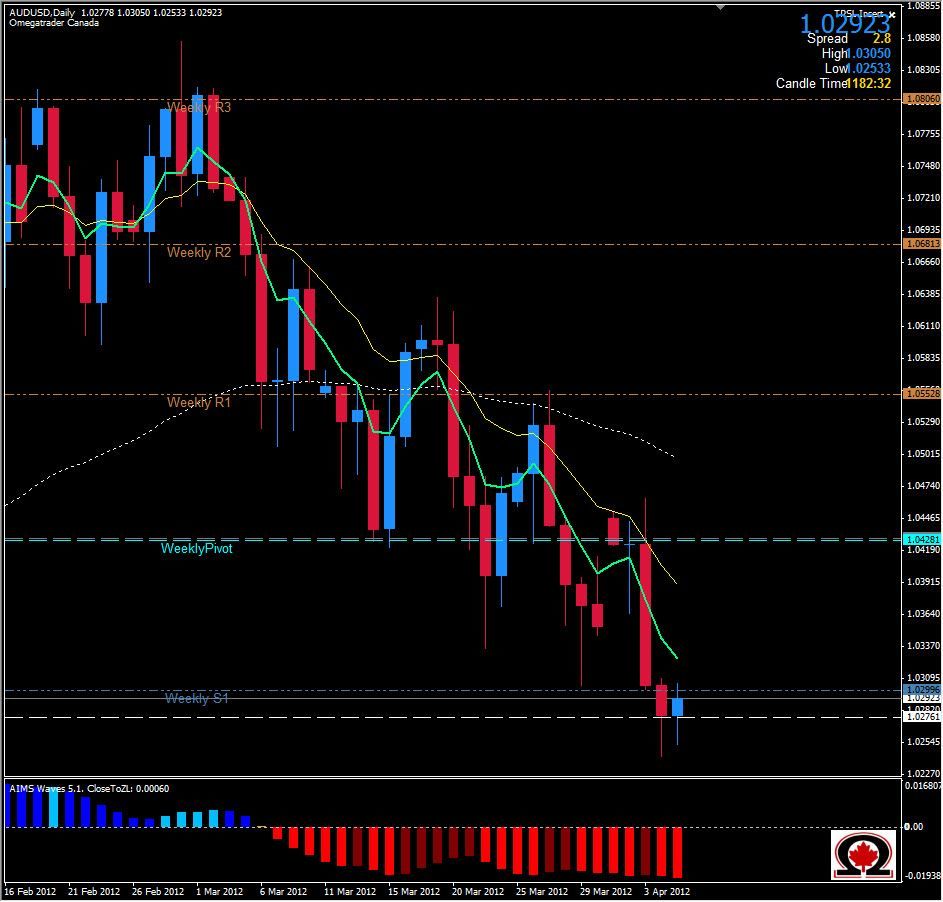

The Australian dollar has, not surprisingly, paused at a strong historical support zone of 1.0276. This has been an important level since December 2010 with the currency pair finding both support and resistance at this level numerous times in the past 2 years. Combined with the Weekly Pivot level at 1.0299 this is a very important zone for the Aussie. As price action has been overly Bearish for the past few days, it is probably that we will at least retrace somewhat from this zone, possibly to the Daily R1 at 1.0311 or even 1.0428 which is the Weekly Pivot. It things continue to head south from here, look for additional support at 1.0260 & 1.0243 before we reach the Weekly S2 at 1.0175. Don't forget that in spite of the Bank Holiday's around the world for Easter, there will be numerous high impact announcements from the USA including Unemployment claims at 8:30AM Eastern and Non Farm Payroll at the same time the following day. These 2 announcements are typically market movers and with only the US financial institutions being open there could be some strong reversals if the news is positive for the Greenback.