By: Colin Jessup

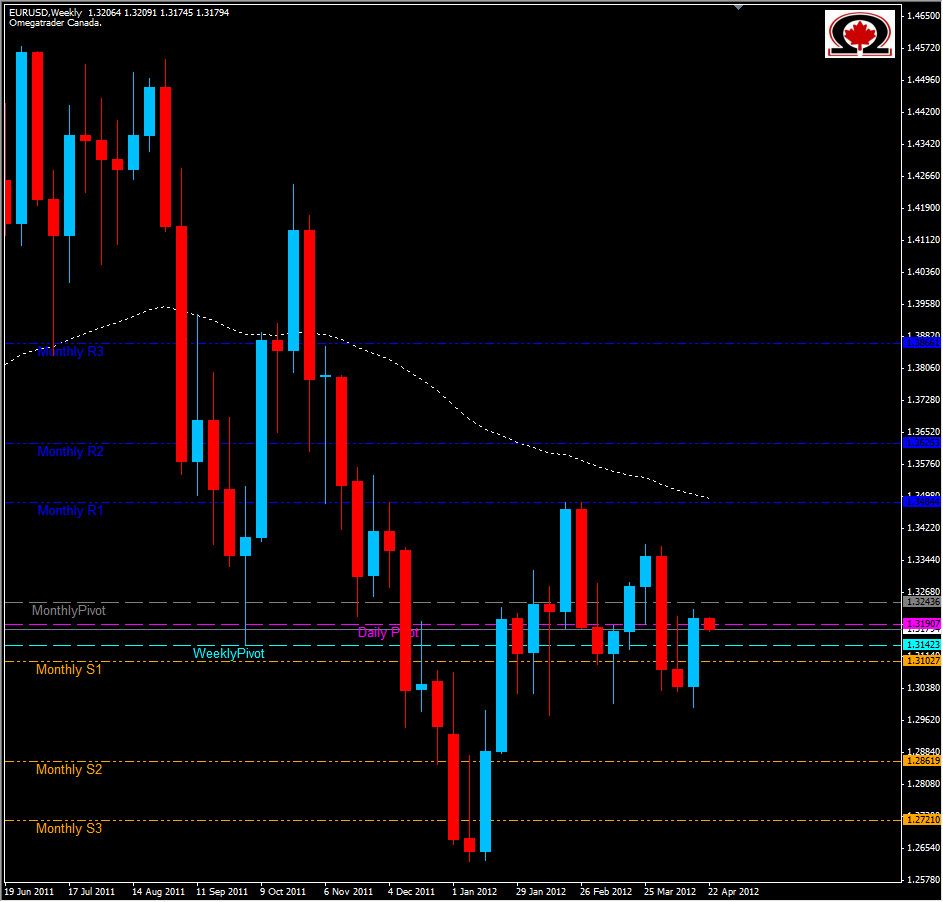

The EUR/USD chart closed the weekly much higher than it opened and printed a bullish engulfing candle off of the strong support zone at 1.3000. While this is typically an excellent indicator that prices will move higher, it does not necessarily happen immediately, often pulling back 30-50% before continuing higher. In this instance, while it has closed above the Daily Pivot, Weekly Pivot and Monthly S1, there is a descending trend-line which meets price at about 1.3265 as well as the Monthly Pivot at 1.3245 and the Weekly R1 sits at 1.3290. What this means is that the EURO has its work cut out to gain some serious ground on the Greenback once again. If price reverses and falls lower, we have support at 1.3142, 1.3103 and 1.3058. The key for this pair to trade higher will be the break and close above last weeks high on at least a daily time frame...above 1.3290 will break the descending trend-line as well and could really push this pair higher.