By: Christopher Lewis

The Japanese Yen is one of the most interesting currencies to me at the moment, as the Bank of Japan continues the quest to kill it off. The market will certainly have to pay attention to the Bank of Japan on Friday, as it is set to announce a furthering of the easing that it has started to undertake. The preferred route seems to be buying JGBs (Japanese Government Bonds) in order to help float the massive debts in Japan. By purchasing these bonds in the place of the public, this is essentially creating Yen out of thin air. In other words, this should drive the value of the Yen down as there are more and more created.

The other currency in this pair, the Canadian dollar, should have a fair amount of demand. The USD/CAD pair broke lower for the session, and this suggests that perhaps we could see overall CAD strength. In this kind of situation, it only makes sense to pay attention to this pair. After all, we have a central bank that is trying to work against its own currency, and another currency trying to break out. The Forex market is essentially about buying a strong currency with a weak one, so trades like this are my personal favorites.

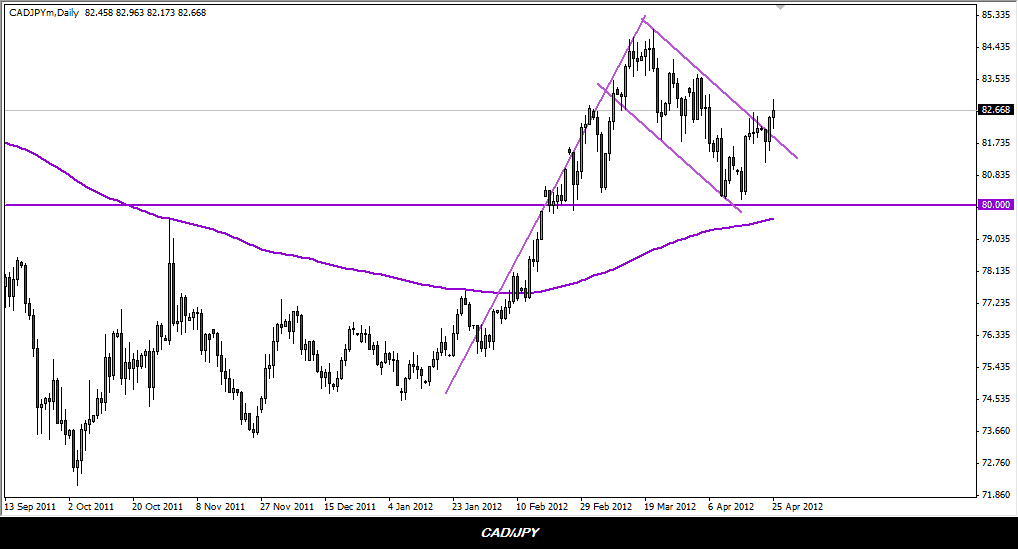

Flag?

It isn’t the prettiest one I have ever seen, but there seems to be a bullish flag that has just broken to the upside in this market. The breakout actually occurred a couple of sessions ago, but it hasn’t completely taken off to the upside yet. The pole is a bit suspect, but even if the flag isn’t true, the downtrend channel being broken certainly is.

The candle for the Wednesday session is a positive one, but relatively neutral. This of course isn’t a huge surprise considering the actions (or inactions) of the Fed for the day, as the commodity markets will be greatly affected by the value and interest rate outlook of the US dollar.

The 200 day EMA is also below the pattern and the breakout could be a significant sign. Because of this, I am buying this pair on dips as long as we are above the 80 level. The move on Friday by the Bank of Japan could surprise, and if it does – this pair could take off. I suspect we are heading to 85 in the near term.