By: Colin Jessup

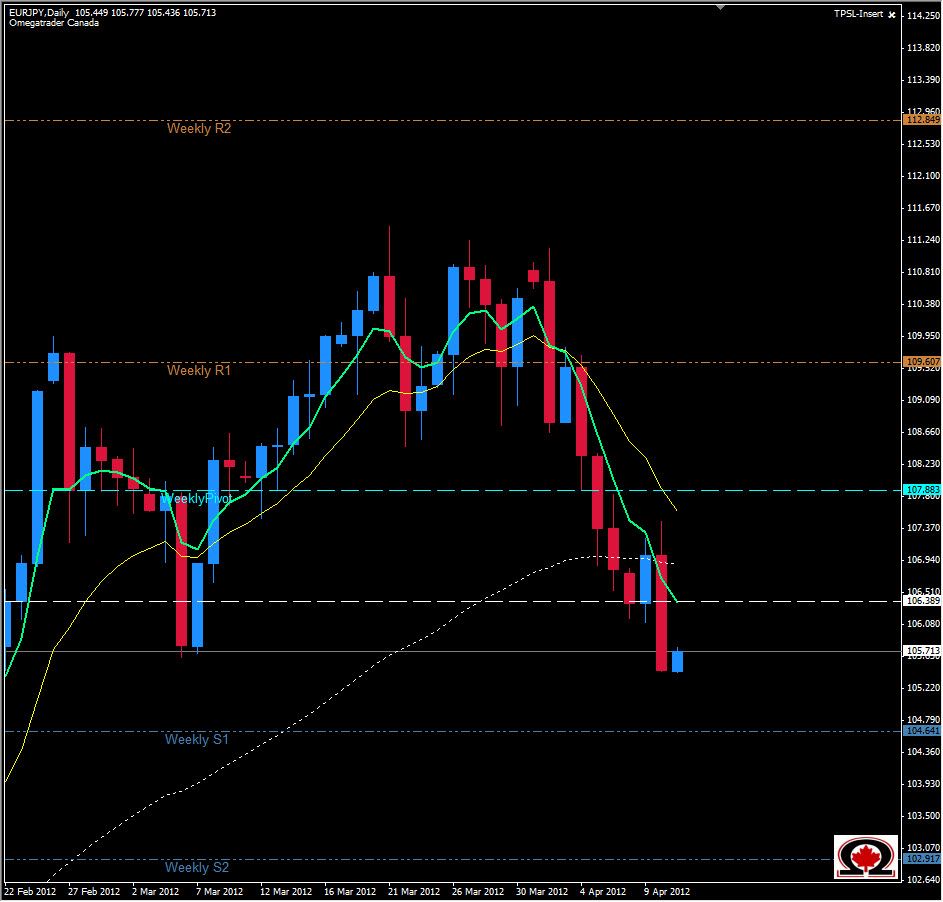

The Japanese Yen had a good day against the Euro yesterday, gaining over 200 points against the consolidated European Currency. The daily candle actually came to a stop right at the Weekly S1 at 82.498 and has retraced only about 25% during Tokyo Trading. This is considering we are about 45 minutes from the BOJ Monthly Report at time of writing and could change in the next hour. Fundamentals aside, the Daily chart also produced a very Bearish Engulfing Candle with a high only .04 pips below the Weekly Pivot and spanning the entire gap between the WP and WS1. It is possible we will retrace as far as 84.50 before resuming the Bearish trend that appears to be continuing. 83.50 will be strong intra-day resistance with the Daily Pivot below at 83.20 providing additional resistance at this level. If the Bearish Trend does indeed continue, there will be Daily Mid Level Support at 82.50 and the Daily S1 at 81.80. The next target for the pair is most likely the Weekly S2 at 81.32 if not lower, possibly 80.55 give or take a few pips. Overall outlook is definitively bearish either way.

Happy Trading!