By: Christopher Lewis

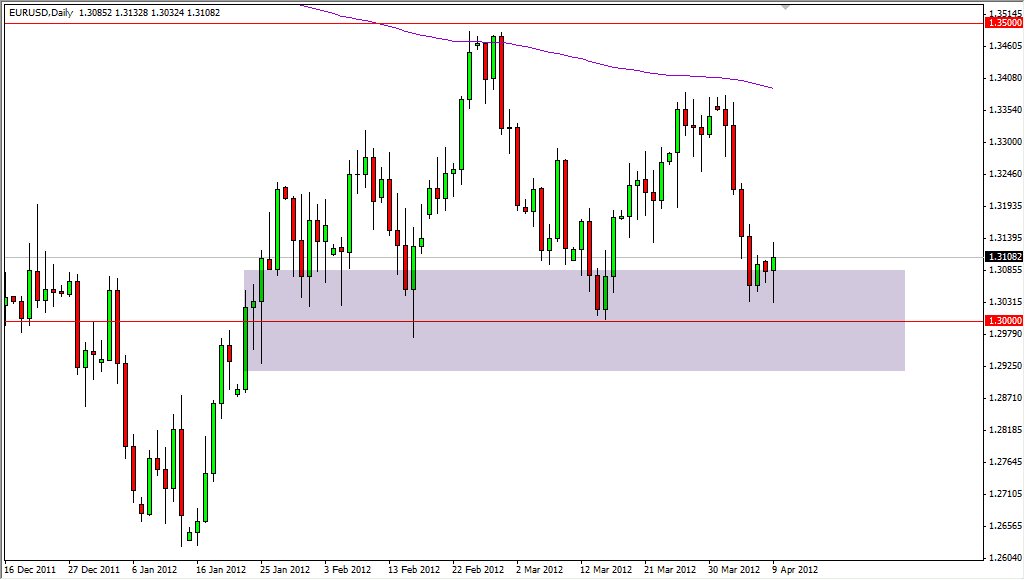

The EUR/USD pair has been one that has been focused on by most traders lately as it fell hard since meeting the 200 day EMA at the 1.3350 level. The pair made a less than stellar ascension this last round, and even failed to make a higher high. The pair looked as if it was trying to find a range between the 1.30 and 1.35 levels.

The candle for the Monday session is in fact a hammer, and this will certainly bring out the bulls in this market. The odd thing about the Euro is that no matter what happens – there is almost always someone willing to defend it. Of course, the same thing could have been said about the MBS (Mortgage Backed Securities) market just a few years ago, so this has to be taken with a grain of salt.

Portuguese banks are borrowing from the ECB in record amounts, so it is probably only a matter of time before the bears start focusing on Portugal with a bit more gusto. The markets in Europe for the bond trader are offering attractive yields, but this is for a reason after all.

The hammer

The hammer that formed for Monday signals that there may be a bounce coming, but I am not found of buying the Euro as there is simply far too much drama in the EU at the moment for me. Instead, I prefer to acknowledge that the pair will probably bounce, and look for weakness to sell. Until then, I will be flat of the pair. If there is a break below the 1.30 level on a daily close though, I am selling this pair aggressively.

On the other hand, if you feel the need to go long – this is a short-term set up. The braking of the top of the Monday session could see this pair trying to reach the 1.3250 level again. However, if you are going to go long of this pair, please keep your stops tight as the European Union is very capable of producing headlines that can drop this pair like a stone at the moment.