By: Colin Jessup

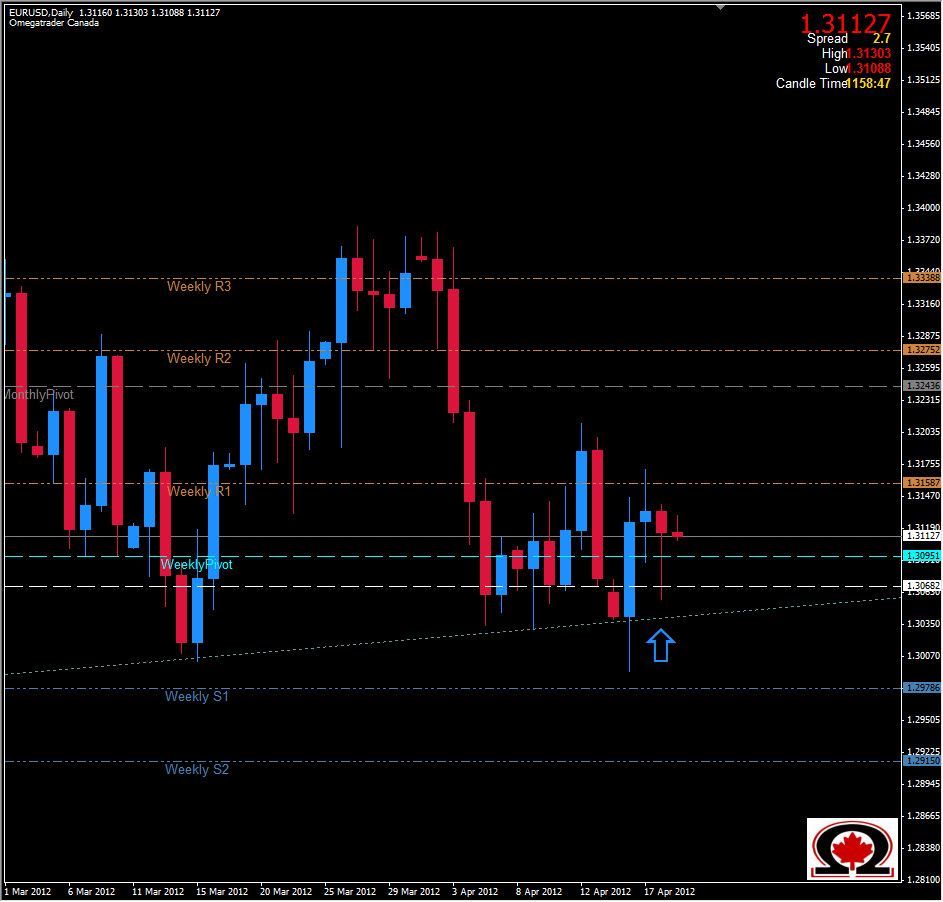

The Fiber, or EUR/USD as most know it, is holding above 1.3100 and appears to be setting up to push higher according to the Daily Chart. Yesterday saw the pair trade as low as 1.3057 but, once again as it has many times at this level, the pair closed much higher at 1.3116. The reasons for the pair having so much difficulty holding below 1.3100 are numerous, from a purely technical standpoint there is some pretty heavy duty support at this level. With a Historical S/R level at 1.3030 that propped the pair up on numerous occasions over the last decade, and the Weekly Pivot at 1.3095 this is a pretty tough nut to crack. The most recent Daily Candle is a reversal candle known to some as a 'Pin Bar' and to others as a 'Hammer', that possibly hints at a break above the Weekly R1 of 1.3158 and a re-test of the Monthly Pivot level around 1.3240. If price 'fades the tail' and falls again, we will see additional support at 1.3086 and 1.3068 before arriving at the Weekly S1 around 1.2978.