By: Colin Jessup

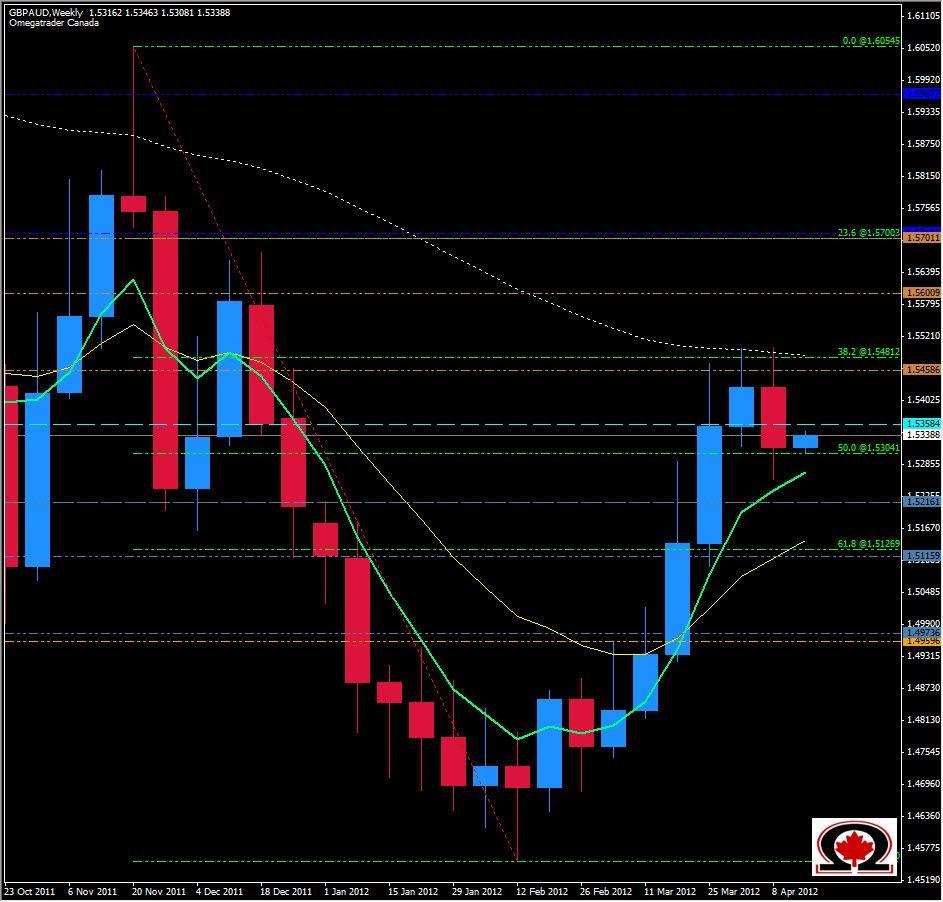

Taking a little excursion into one of the more unique trading pairs to start off the trading week, we will have a look at the GBP/AUD. Last week the pair tested the same high as the week before and broke it by 10 pips, making a new high of 1.55008 as well as a lower low at 1.52583. This has created a Bearish Engulfing pattern at a strong level of resistance. The 62 Moving Average diverged with the Weekly R1 and the 38.2% retracement level for the period between November 2011 and Mid-February of this year. Price is currently trading only about 20 pips below the Weekly Pivot at 1.53584 and just above the 50% level at 1.53041. With such strong resistance above, and the engulfing of the prior weeks activity, this is a high probability turning point for the pair. From an Intra-day trading perspective, look for price to retest the weekly Pivot then possibly turn lower, setting its sights on the Daily Pivot at 1.5298 and the support levels of 1.52371 and 1.52161 below that. If this pair does continue its Bearish undertone, I expect it will close the week somewhere down at or below 1.5100. If this was just a consolidation period and price moves higher, look for targets such as 1.5480 again, then 1.5600 or 1.5700 by the end of the week or month. Note that price has been mostly Bullish during the Asian sessions today, also an indication that lower prices may prevail after the London & New York sessions open.