By: Christopher Lewis

The GBP/USD pair has been one that is in transition. The British Pound has long been thought of as a currency representative of the weak UK economy. In fact, many people had anticipated that the Bank of England was going to add to the previous round of quantitative easing, and as a result many people doubted the Pound strength that had been seen.

However, the BoE has made it clear that another round of easing isn’t going to happen. In fact, there is even some talk of the British economy being at risk to suffer inflation, and this could mean higher interest rates attached to the Pound. Needless to say, this pushes the Pound higher against most other currencies, and with the lack of any clear direction out of the Federal Reserve, the Dollar isn’t going to be any different.

Breakout

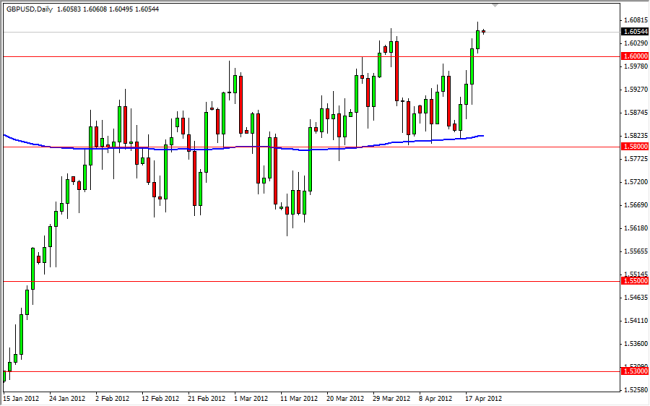

The pair looks as if it has broken out of the previous resistance band, which was between the 1.60 and 1.6050 levels. The area has been pushing prices down for a while, but the lows kept getting higher, suggesting that the bullish pressure was mounting. The 200 day EMA was just below as well and as a result we saw quite a few trend traders enter as well. Once we got inflation fears out of the BoE, it was essentially the nail in the coffin.

The level giving way is significant, and it signals that the pair will continue higher. However, there are a lot of noisy patterns between the 1.60 and 1.65 levels, so this could be a real grind higher. However, as a bonus – you get paid to wait on this move as the swap is positive when you buy. With this being the case, I think we will see continued pressure to the upside, although there are going to be trials on the way up. If you are patient, this could be a solid trade. I am currently buying on pullbacks, and will add incrementally on the way up. As long as we are above the 1.59 handle, I fell being long or flat are the only two possibilities.