Trades placed by optionFair

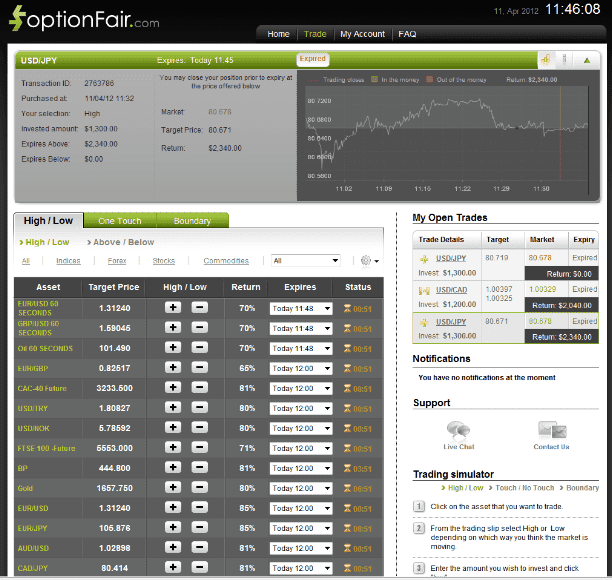

USD/JPY

Christopher Lewis’s analysis has been one of my favorites lately, usually directing me in the right direction more often than not.

According to Lewis, the USD/JPY pair is steadily heading down towards the 80.00’s level - a great investment opportunity for the “Low”, “Touch down” or “No touch” instruments.

I’m currently trading with OptionFair as my main binary options trading platform (so far so good), and the following trade was made through their services. I’ve traded $1300 on the "Low" instrument with a return of 80% if the option expires below the strike price. Basically, that means that if i'm correct, I’ll be $1,040 richer. The market price for the USD/JPY at the buying time (11:32) was 80.671 and expiry took place at 11:45 at the price of 80.678, meaning that I've won my position.

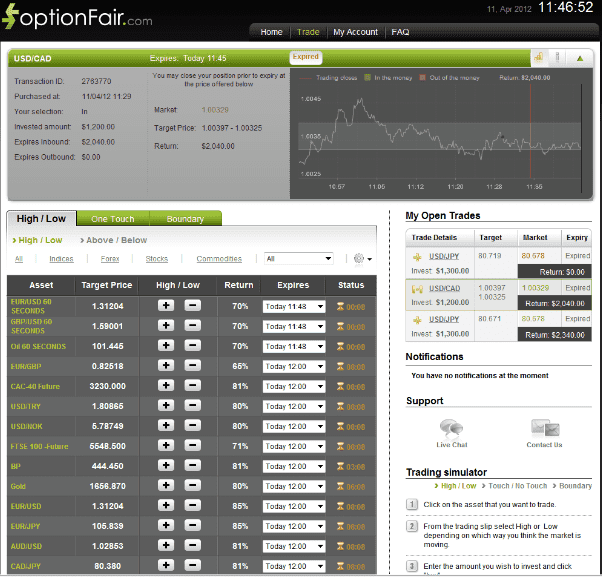

USD/CAD

Following Christopher Lewis’s analysis of the USD/CAD, it was clear that the pair had a final resistance (the “invisible wall” that the asset seemed to not surpass) at 1.01 that needed to break so it can move any higher. As for selling the pair, a weak candle wass needed in order to verify the movement. This setup creates a solid investment opportunity using the “In” instrument.

I’ve been using OptionFair for some time now and it has been performing without any hiccups, so it was my natural choice for a delicate situation like this. As for the trade itself - I’ve traded $1200 on the "In" instrument and had a 70% return if the option expires between the boundaries. In simple terms, I’ll be earning $840 on my investment if I’m “in-the-money”.

Eventually, The option expired at the price of 1.00329 (between the boundary range), so I’ve won. More specifically, the market price for USD/CAD at the buying time (11:29) was 1.00361 and the boundary range was 1.00325 - 1.00397 for 11:45 expiry.