By: Colin Jessup

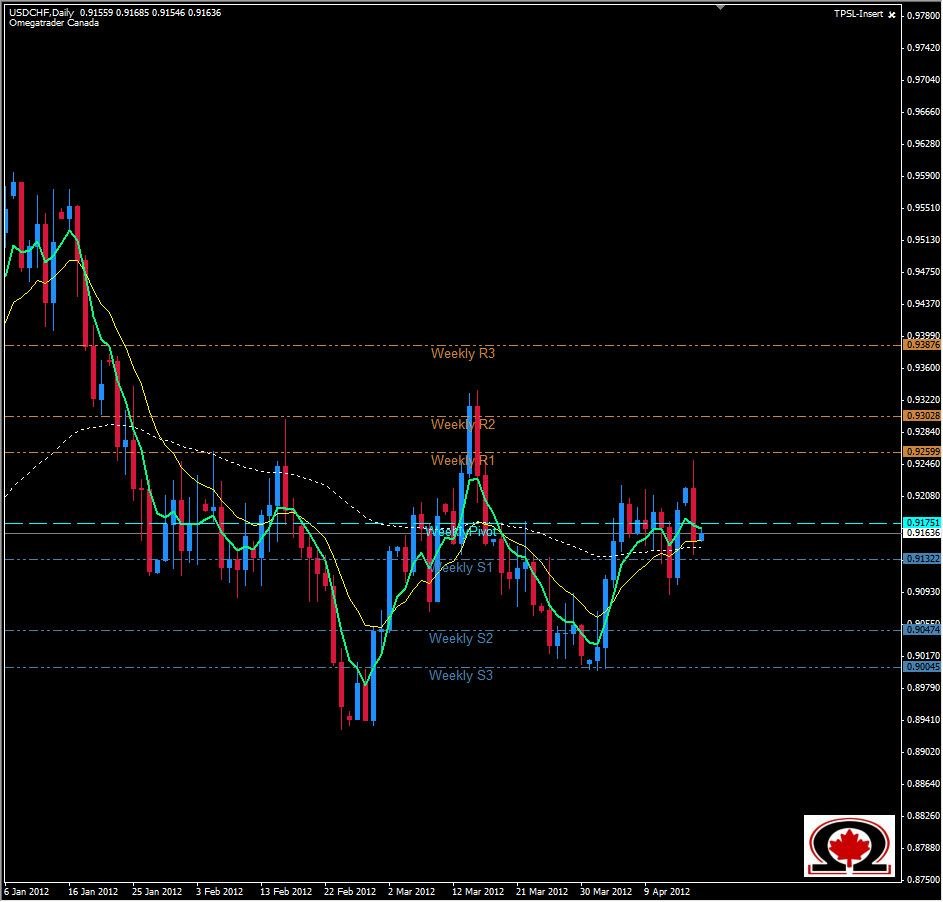

The USD/CHF appears to be forming the right shoulder of a classic Head & Shoulders formation indicting that the Swiss Currency could gain once again on the Greenback and send the Daily charts into the lower territory. Today's trading saw the pair push as high as 0.9251 which just happens to be the 50% retracement level between the January 2012 high and the February 2012 low. The candle that printed at this level is also a very Bearish candle that closed below the 38.2% level at 0.9176. While Resistance is strong above with the Weekly R1 intersecting with the previously quoted 50% level, Support below is also strong with the Weekly S1 at 0.9132 and Daily S1 only a few pips lower at 0.9113. Immediately below the current price of 0.9164 we have the DM3 level at 0.9147 which will need to be broken before any further gains can be made by the Swissy. For the pair to be considered truly Bearish, we will need to see a close below 0.9087...this is the point at which we will confirm a potential bearish trend resumption.