By: Colin Jessup

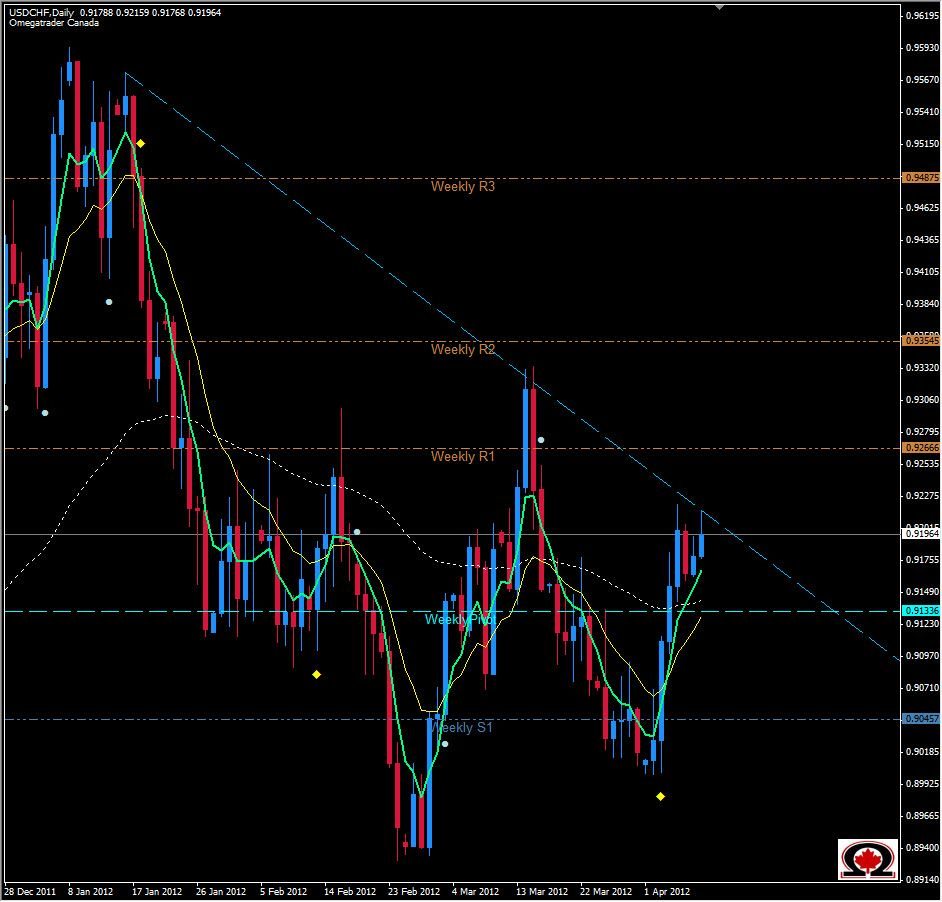

The US Dollar has been gaining on the Swiss Franc since making a higher low at around 0.9005 last week with only a slight pullback on the Daily chart occurring last Friday, when most markets were closed and the US released some slightly better than expected numbers in unemployment claims. There are 2 key factors to where this pair might be headed, from a purely technical standpoint, the pair has closed above the 62 Daily Moving Average for the second time in the last 30 days indicating a possible Bullish continuation. However, the chart is currently also showing a Head & Shoulders formation with the current price level being the perfect turning point to complete the right shoulder and turn Bearish.

With mixed fundamentals being released almost daily, it is more and more important to to ignore all but the highest impact releases, and focus purely on the Technical. Arguments for Bullish continuation include candles floating above the Weekly Pivot at 0.9133 and a 100+ pip technical vacuum above 0.9221 could pull the pair higher if broken. Bears might argue however, the previously mentioned possible H&S formation as well as the descending trend-line, that is now confirmed with the 3rd touch being today's current high, that will provide additional resistance for the pair. My traders instinct tells me it will go higher, but might pull back to about 0.9130 first and then break the descending trend-line with strength. Simply put, if price closes above 0.9221 we will surely test 0.9260 if not 0.9350, but if price closes below 0.9130 we could see 0.9045 again by the end of the week.