By: Christopher Lewis

The Russian Ruble isn’t necessarily a currency that many of you will follow, but there are some advantages to keeping track of the way it moves. In order to understand what the Ruble means to the Forex world, you need to think about the area of Siberia. The oil fields in Siberia are vast, so this currency will often track the oil markets, but in inverse as the Dollar is the front of the equation.

The pair is most decidedly in a down trend, and as a result the smartest trade is always going to be to sell it. This makes sense as the oil markets have been so strong until recently. The pair also has the added benefit of tracking as an “emerging market” play as well. The Russian economy is expanding as the oil services and drilling industries continues to advance overall. Also, there is a lot of infrastructure needs in the country as well, and the economy is still trying to adjust to the effects of converting to capitalism.

Shooting star

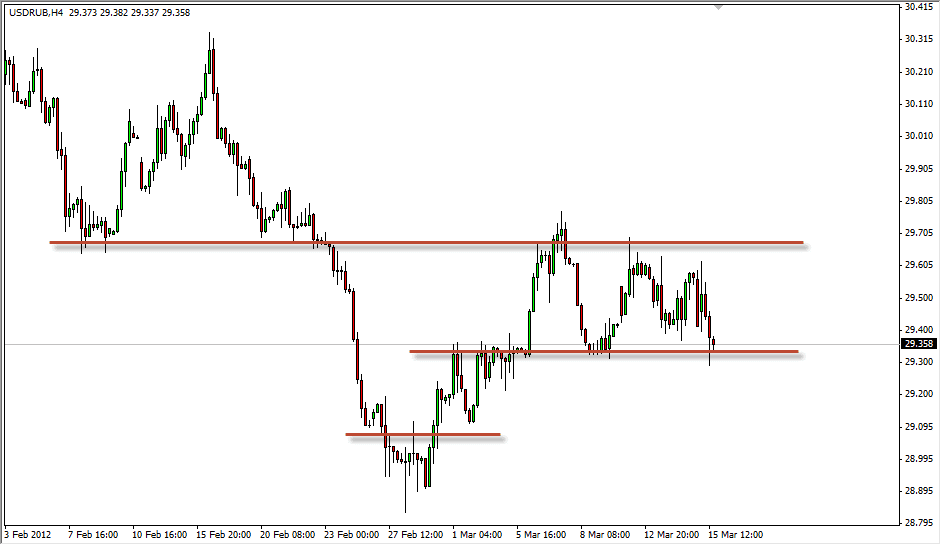

The Monday session saw a rise in price, but the pair fell by the end of the day in order to form a shooting star. The area is also the top of a recent range, much like the USD/CAD pair. In fact, this pair will often move in tandem with the USD/CAD market, so while the markets may be similar, there is often a difference on the candles – therefore giving better setups in one market or another.

The range that we are in allows me to have a very rigid “box” from which to trade in. The 29.80 level is at the top of the shooting star, and the start of resistance at the 30 handle. The 29 level also seems to be supportive to me as well. The one thing that you have to keep in mind with this pair is that the pip value is higher, so you should keep this in mind as you trade it. In other words, a 25 pip move in this pair matters much more than a 25 pip move in USD/CAD.