By: Christopher Lewis

EUR/USD

The EUR/USD pair managed to form a hammer just over the recent resistance level at the 1.3250 to 1.33 area. This looks as if we are about to see a move higher, but the 1.35 level above could cause serious issues. The longer-term trader may do well to avoid going long until the 1.35 level is proven to give way. Shorter-term traders will more than likely enjoy a bullish move, but for just a hundred pips or so.

.png)

USD/CAD

This pair continues to fail at the parity level. The bulls have been relentless in their drive to push prices higher, but the market simply refuses to budge above the parity level on a close. The 1.01 level is the top of the resistance level as far as I can tell, so it would take a daily close above that level for me to get overly bullish of it.

On the downside, I see the 0.98 level as supportive as well. This pair has been profitable for me as a short from parity several times over lately. However, for a longer-term sell – I need to see 0.98 broken.

.png)

AUD/USD

The AUD/USD pair continues to grind lower. The 50% Fibonacci level is now in place and being tested. The Chinese economy is going to be the biggest driver of this pair going forward, and fears of a slowdown in that region will weigh on this pair it is comes to be true. There are various economic numbers coming out of China over the weekend, and bad numbers will push this pair down.

The area we are trading in now has to hold as support, or we could go lower. I don’t like selling even if we do as there are many support levels, both major and minor below. I prefer to be long above the 1.04 level if it happens.

.png)

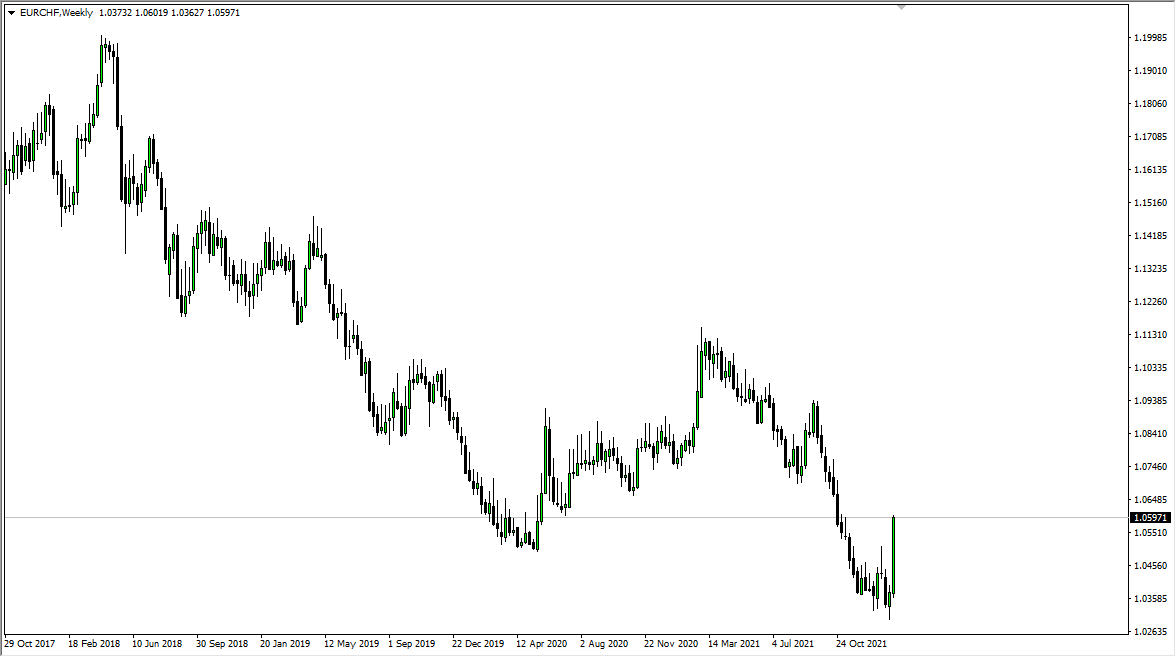

EUR/CHF

The EUR/CHF pair is one that most traders have simply forgotten about over the last several months, and quite frankly, I can see why. However, on Friday we saw a selloff in this pair that pushed it down to the 1.2037 level. This is getting dangerously close to the “minimum acceptable exchange rate” in this pair as dictated by the Swiss National Bank. Because of this, perhaps the easiest trade in Forex at the moment is to buy this pair, and take profits on the pop. With a little luck, the bears will push the pair down enough to trigger intervention. If that happens, we should see 1.24 fairly quick.