By: Christopher Lewis

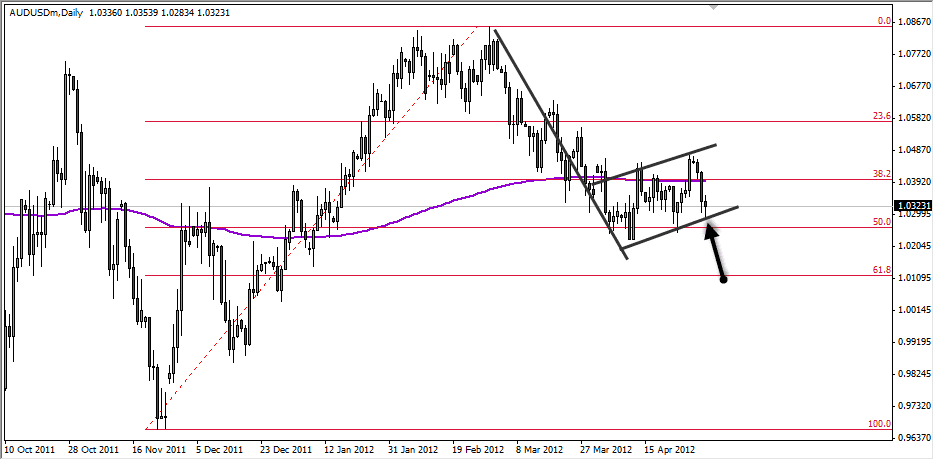

AUD/USD fell for most of the session on Wednesday as the “risk off” attitude came back into the markets in general. As the price of commodities fall, the Aussie will often lose strength, so the move for the session wasn’t exactly shocking. Having said this, by the end of the session this pair had bounced quite a bit, and formed a hammer.

The hammer is at the 1.03 handle, and this is an area that I have notice support at just after the larger than expected rate cut out of the Reserve Bank of Australia the other day. The area kept the market up, and the knee-jerk reaction was stalled at that level. Because of this, there is a real chance that this pair has limited downside.

The 200 day exponential moving average is just above, and this could cause some problems for the bulls going forward. However, the market looks somewhat consolidative in general, so the level has given way several times recently, and the resistance will be minimal.

One chart, two stories?

The charts do look as if they are trying to suggest support in the area, as the last couple of lows have progressively gotten lower. The market looks as if it wants to try and bounce and the Friday Non-Farm Payroll numbers will move this market as it is a proxy for risk in the Forex markets.

However, when you look at this chart, there is one glaring trouble sign. When looked at from the longer-term, this pair almost looks as if it is currently trying to form a bearish flag. If this is the case, we could be falling much lower. However, if the pair was to fall like this would suggest, it would mean that the global economy will have more than likely had a shock or two. Although this is hardly a stretch of the imagination after the last couple of years, it could be telling. It is because of this that I actually have a two-fold trade set up at the moment.

A break of the top of the Wednesday candle would trigger a buy order for me as it is classic technical analysis. However, if we break below the 1.02 handle – I am selling this pair as it would suggest the possible bearish flag has triggered.