By: Christopher Lewis

EUR/USD fell hard on Wednesday as the downtrend line continues to keep the bulls at bay. The pair is one that I only sell – and sometimes get grief for doing so – but overall, you can’t help but think that Europe simply isn’t worth bothering with. After all, when something is so complex that it becomes difficult to understand, should you be investing in it? This is essentially what you do when you buy the Euro – invest in the European Union. Granted, many Forex traders don’t trade long enough for it to actually be this way, but in the long run it’s a true statement.

Simply put, headlines can move currency pairs wildly. In this situation, one has to ask themselves if they think that positive or negative headlines are more likely. This information can lead to a bias, and when the charts suggest this as well – you have the basis of a working trading thesis. For me, I don’t necessarily love the Dollar, but I can’t justify owning the Euro.

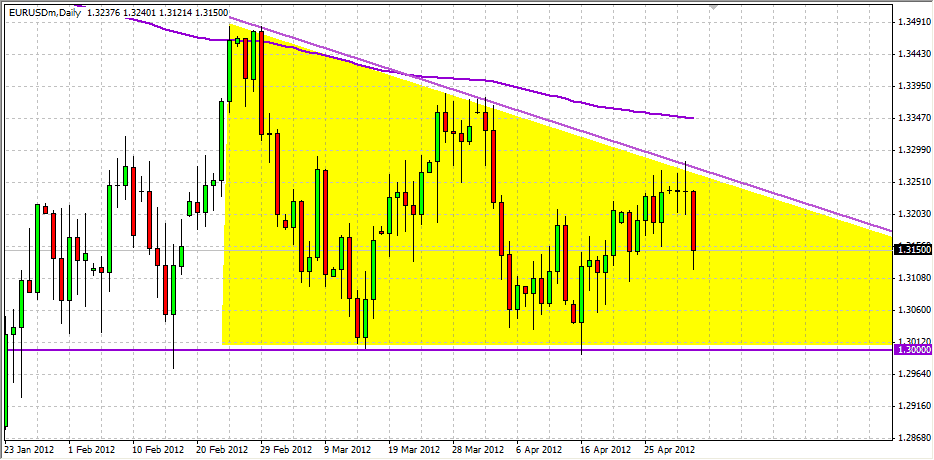

Triangle…could be!

The downtrend channel that sits just above the current trading levels looks to me like the start of a descending triangle. If this is so, there is a real chance of a breakdown in this pair going forward, and the level that the market would be running to would be roughly 1.25, with the 1.26 level being an obvious support level as it was the last massive low in this pair.

The European Union sees a few elections in the next few days, and troubles could come out of both Athens and Paris as the wrong words from the eventual winners could send the markets running. The Socialists in France could eventually demand a renegotiation of the austerity measures in Europe, and it seems almost a given that the Greeks will as well. (Yet again.)

Because of this, I only sell. I would sell a break of the lows from Wednesday or somewhere close to the downtrend line if we rally. As for buying, I would have to see a post 1.35 daily close in order to start thinking about it.