By: Colin Jessup

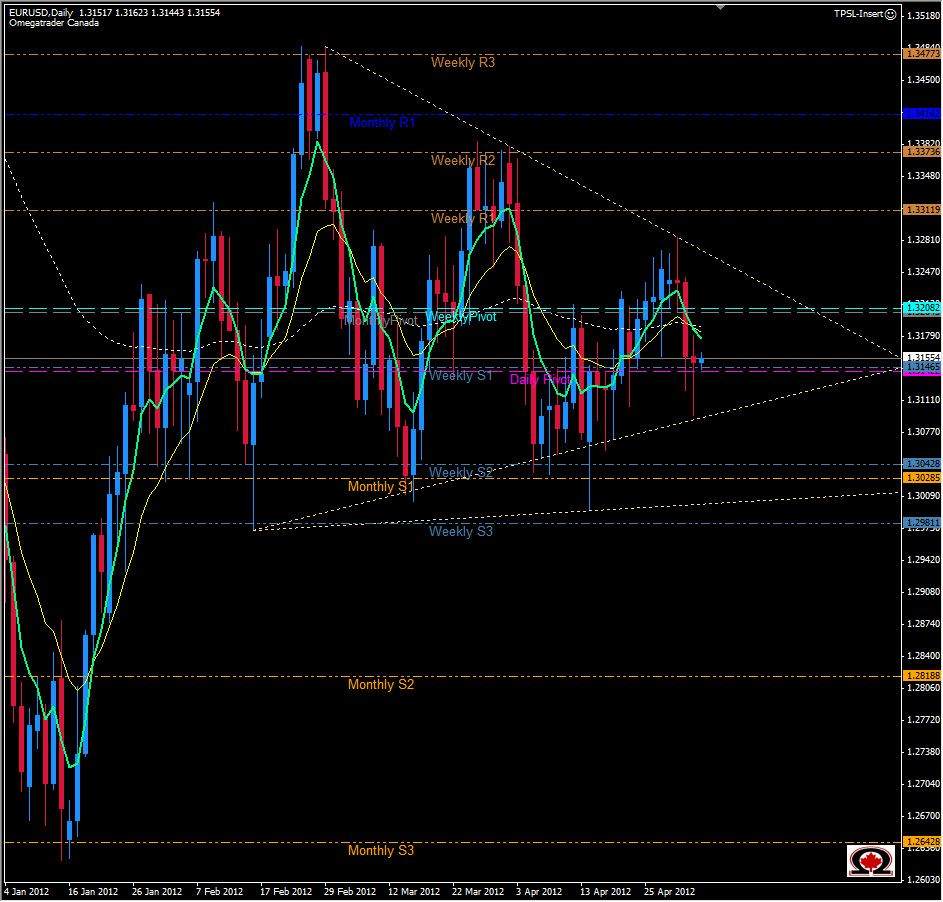

The EUR/USD has been trading in an increasingly tighter range since January of this year, and as a result will soon reach a point where it will simply have to break one way or the other...my money is on higher. The highs have been lower highs much more so than the lows have been higher lows...if that makes any sense. The formation we have on the daily chart shows a much steeper angle to the descending trend-line drawn on the highs, than the same drawn on the lows...creating a flat bottom flag. This formation is typically an indication that price will break out to the upside, but there are no guarantees of course. With price currently trading just above the combined Weekly S1/Daily Pivot at 1.3145, there is clearly strong support here and it would not be unreasonable to expect price to climb back up to the combined Weekly/Monthly Pivots above at 1.3200 and then turn Bearish at around 1.3250. Support below is also seen at around 1.3100, the point that the ascending trend-line intersects and then we have the Weekly S2/Monthly S1 parallel to each other at 1.3042 & 1.3028 respectively. As the last day of trading is Non Farm Payroll day in the USA, it might be prudent to wait & see if the Euro can break out of its box.

Happy Trading!