The GBP/JPY pair is one that a lot of traders fear. In my estimation, the pair truthfully isn’t much different than any other one. The misconception about this pair is stemmed from the fact that it is a slightly less liquid market, so it tends to move a bit quicker than EUR/USD, USD/CHF, or even USD/JPY. However, the mechanics aren’t any different.

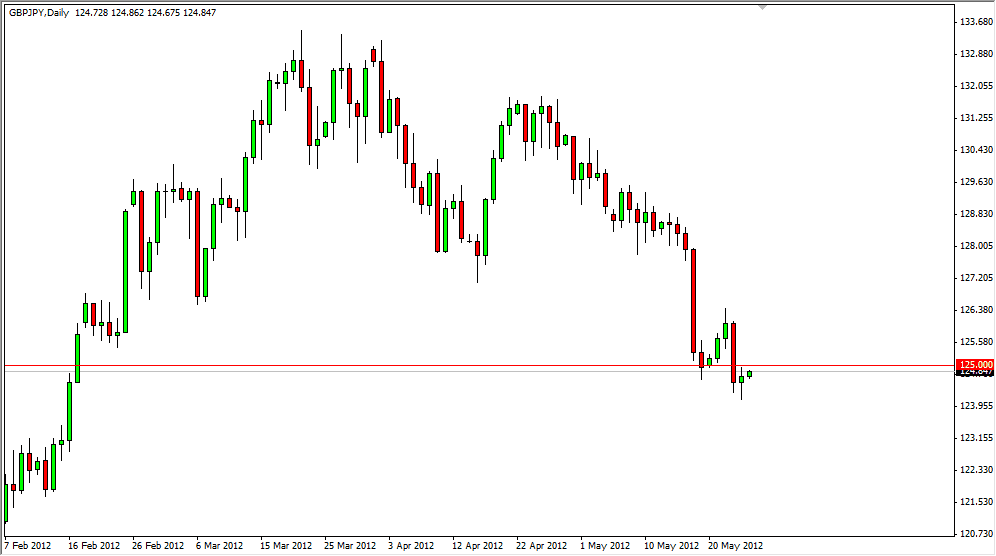

The pair is highly risk sensitive, and as the global appetite for risk comes off, this pair will fall rapidly. The pair has recently plunged below the 125 level, but on Thursday formed a hammer just below it. This suggests that the bulls are ready to come into the pair and push prices higher from what I can tell.

The pair is one that can move a couple of hundred pips in a session, so the position size should be kept a bit smaller than other pairs. Once you do this – the pair can trade the same basically. This can be a very lucrative pair if you are willing to pay attention to the larger time frames as well, as a pair that moves like this can be very difficult to trade on the smaller time frames like the 15 minute charts as they will be very noisy.

Hammer time!

The hammer on Thursday really couldn’t be placed in a more perfect region on this chart in my opinion. The 1.25 level has been serious support and resistance in the past, and it is a nice obvious large round number to attract a lot of traders. This is exactly where I like to see big, dumb, obvious signals. The more obvious – the more of you out there that will join me in order to push prices higher.

The move more than likely won’t be a trend changing one, but I think a real pop could come from this, as the pair is most definitely oversold. However, if the candle gets broken on the bottom of the range – this pair would fall apart and I would sell aggressively. I will be buying on a break of the top of the range for the Thursday session as well.