The NZD/JPY pair is one of my favorites to play when it comes to a global risk appetite inspired trade. Many traders will look to the AUD/USD, and sometimes even the AUD/JPY, but the Kiwi gets little love from them because most simply think it far too illiquid to trade. This in fact, is by far its biggest advantage.

Granted, I don’t trade the NZD/JPY pair for fun, nor do I do it on a regular basis. However, the pair isn’t really much different than other ones, just that it tends to move a bit more. This can be compensated for by cutting down position sizes, or tightening stops if you are truly confident in the next move.

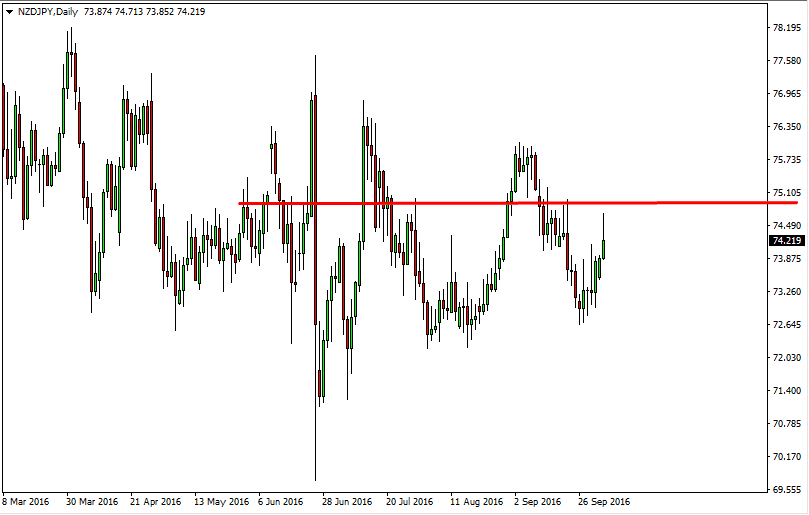

When the global markets are nervous, this pair absolutely falls apart. I have to admit that most of the time I short this pair when I trade it, simply because it is the easiest way to see a return – short this pair on seriously bad news. You can see that lately, this pair has fallen off of a cliff, as we have lost a little over 6 handles in the last month. The bad news out of Europe is most certainly to blame for a lot of it, and as a result I think it is pretty obvious about what the trend in this pair is now.

60

The 60 handle looks to be a significant one, and the round number certainly will attract traders as well. The candle for the Friday session ended up being a shooting star, and this suggests that the bearish pressure remains. If this level gives way, there is a good chance that we see 55 before it is all said and done in this market.

The daily close below the 60 handle could be used as a signal to short this pair. Obviously, the trend is down so I will only sell the rallies – not buy them. The signal to short this pair will more than likely be an obvious news event out of the EU that gets the market riled up again.