By: Colin Jessup

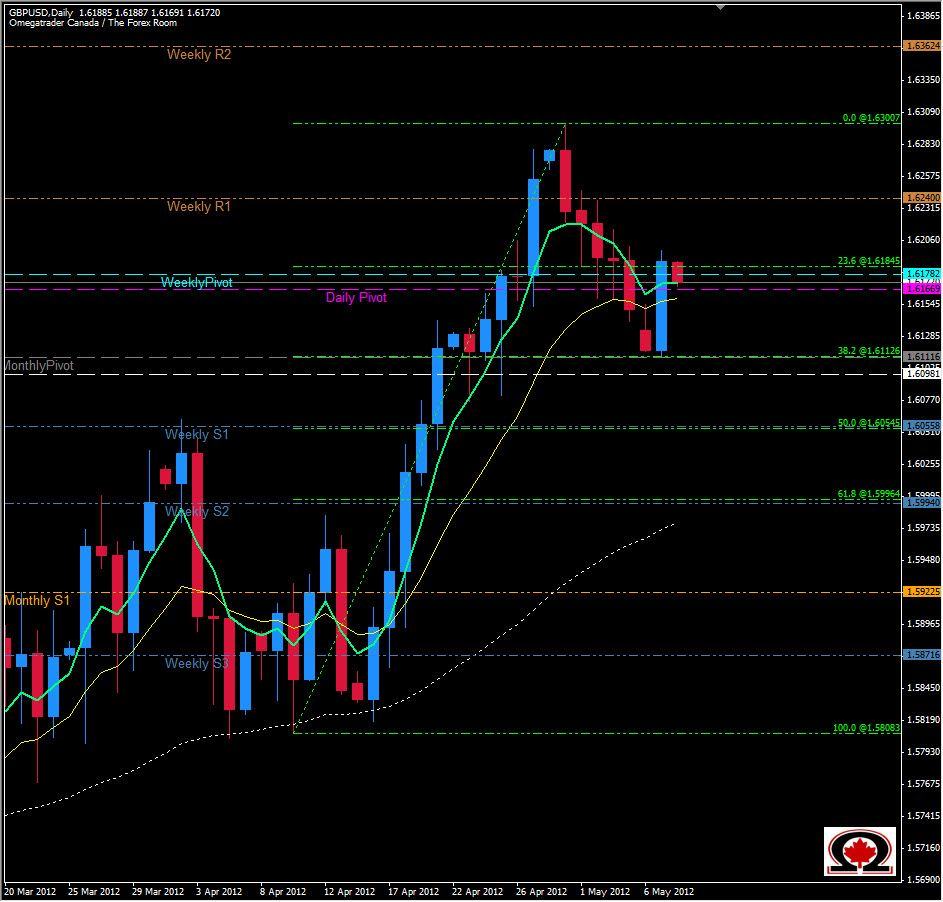

The GBP/USD has completed a picture perfect 38.2% retracement with last weeks pullback off the highest level seen in almost 2 years. After hitting 1.63007 on April 30th, the pair fell for the next week to 1.6113, which is the Monthly Pivot as well as the 38.2% retracement level for the move up that started on April 16th of this year. Today we saw the pair turn Bullish once again, moving from 1.6113 to a high of 1.6198 and closing above both the Weekly & Daily Pivot levels at 1.6178. Price completely engulfed last Friday's Bearish action before the day's session closed. Now it is highly probable that we will see price re-test the 1.6300 level with the Weekly R1 offering resistance on the way up at 1.6240...beyond that the most likely target will be the Weekly R2 at 1.6362. To the downside price will encounter support again at 1.6167, price being unsuccessful during Asian trading to break this level and then 1.6145 may offer some support with the Monthly Pivot sitting directly below. With so much strong support below it will take some work for the Bears to resume a downward trend.