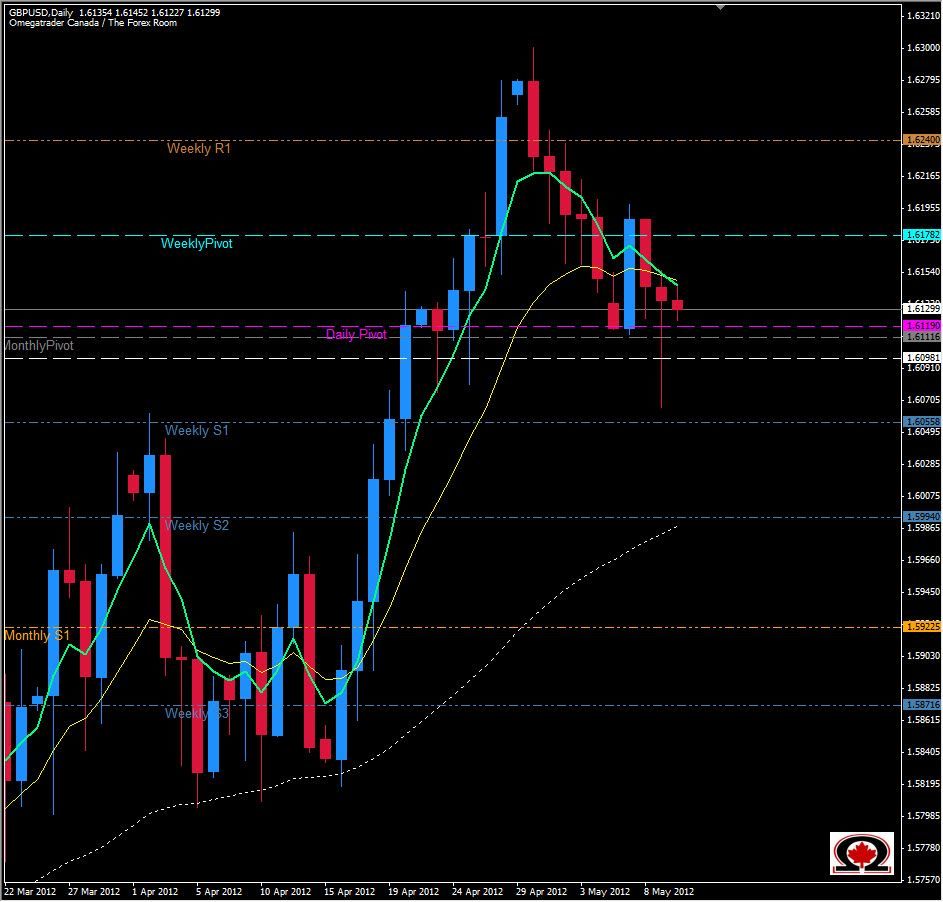

The GBP/USD traded as low as 1.6066 early in the New York session and rebounded to close at 1.6135. This price action formed a potential pin bar reversal off of the 50% retracement level for the period between the low on April 16 and the high of April 30th. With strong support at the 1.6100 level such as the Daily Pivot, Monthly Pivot and a zone manually calculated by the close of weekly candles, this is an excellent spot for technical traders to look at going long once again. Numerous times since 2009 price has hit this level and reversed, and considering the mixed financial reports coming out of the USA it is highly probable that the Pound will strengthen against the Greenback soon. If price does in fact aim higher, we will most likely see a re-test of the 1.6250 level or higher in the next week or two, but if price fades and trades lower, look for another stopping level at around 1.5980 (the current 62 DMA). weekly S1 & S2 are sitting at 1.6055 & 1.5994 with the Weekly Pivot offering resistance at 1.6178 followed by the Weekly R1 at 1.6240.