EUR/USD

The EUR/USD pair had an absolutely horrible week for the bulls. The candle for the 5 sessions ended up at the very lows and is also hugging the 1.25 level. This area simply must hold if the bulls are to have any chance. Truthfully, a bounce could happen, but it will more than likely only offer selling opportunities until the June 17th Greek elections. The 1.30 level to the top is going to be the lid on this market for some time.

.png)

AUD/USD

The Aussie dollar had a negative week as well, but managed a bit of a bounce at the 0.97 level. This area has been the top of a serious support zone recently, so a bounce isn’t out of the question. The real problem with this pair going forward is that the Aussie is so highly correlated with global risk and commodity prices. As long as there are fears out of Europe, this is going to be a “sell on the rallies” type of pair. I expect any bounces to run into trouble at parity, and most assuredly at the 1.02 level.

.png)

GBP/USD

The cable pair had a horrific week as the action was pretty much straight down. As you can see on the attached chart, there is a serious amount of support at the 1.5650 level. This area that we are testing at the moment could decide the next several hundred pips in this market, and a breakdown would send this pair to at least 1.55, and more than likely 1.53 before it is all said and done. The level is also the 61.8% Fibonacci level from the lows, so those traders will be watching this area as well. This pair looks weak, and will be sold by me on rallies, and sold hand over fist if it falls.

.png)

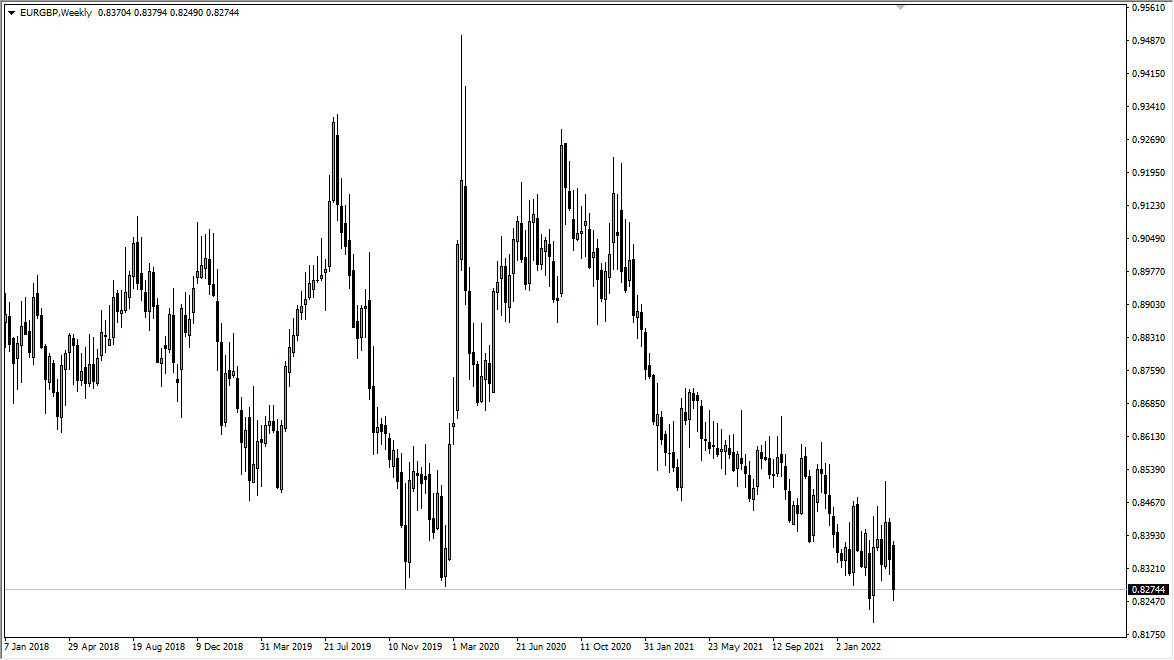

EUR/GBP

The EUR/GBP pair has been pretty much relentless in its fall over the last couple of months. The area that the market is testing at the moment is the 0.80 handle. This area has been a sort of “equilibrium” in this pair historically, and the fact that we are testing the bottom of a hammer form the week before in this area is very interesting indeed. I think any strength in this pair should be sold, but a break of the previous week’s hammer to the downside would have the pair falling hard.