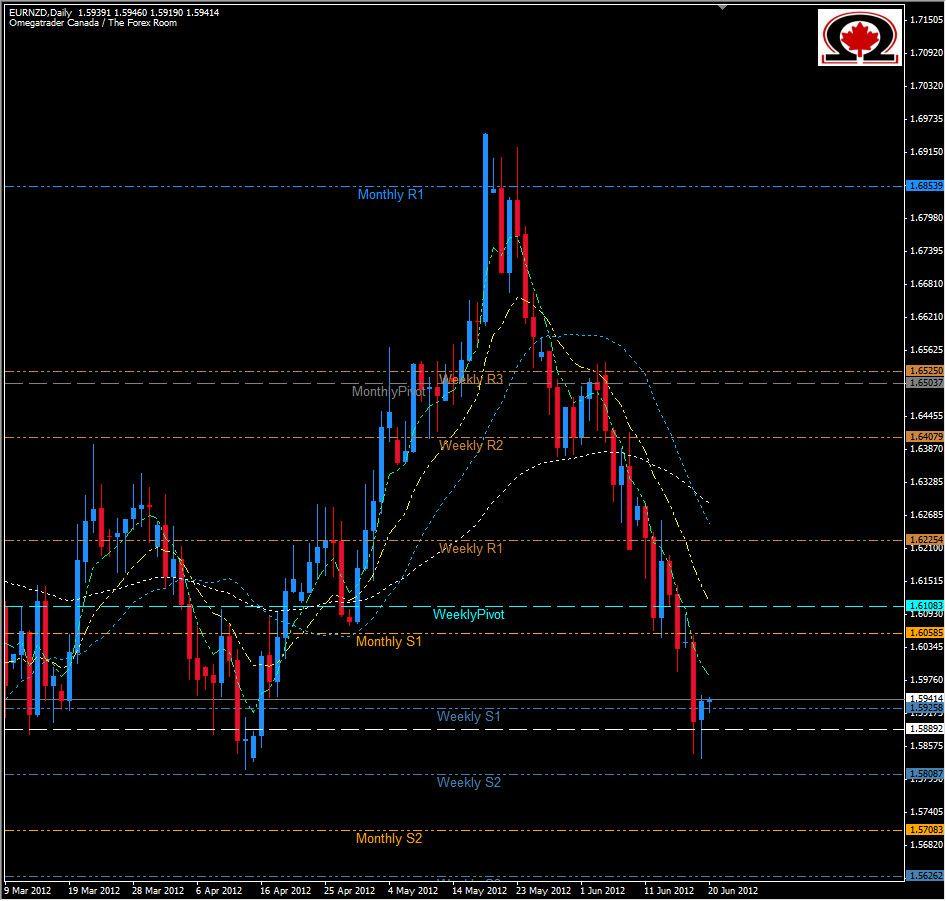

And now for something a little different...the EUR/NZD is definitely not one of the 'major' currency pairs but offers some nice trading opportunities all the same. Yesterday the pair printed a pin bar with a long tail and a close higher than open, after making a higher low on the Daily Chart. The pair was last at this price level on April 13 of this year where it printed a similar candle and then proceeded to climb until May 18 when it reached a high not seen since December 2011. After peaking it fell, pausing only at the 1.6400 level for a 6 day consolidation and has now returned to where it started back in April. With the formation of the Daily Pin Bar, taking into account how price reacted at this level previously, there is a strong possibility that price will reverse and begin trading higher, most likely to the Weekly Pivot at 16108 at least and possibly to the Weekly R1 (also the 38.2% Fibo) at 1.6240. If price does continue to fall and breaks the previous low at 1.58177 the next target will be 1.55889, the all time low for this pair reached in February 2012. With such a strong down trend it can be risky to consider buying, but considering the facts it might just be worth the risk.