GBP/CHF had a slightly negative session on Wednesday as the markets fell to retest the 1.50 level for support. This pair is one that I don't cover very often, but is without a doubt one that can produce fireworks from time to time. Traditionally, this is a risk on trade when you go long. The reason being that the Swiss franc is considered one of the biggest safe haven currencies in the world.

One of the biggest things working in this pairs advantage at the moment is the fact that the Swiss National Bank has openly stated that it is buying British pounds in order to diversify its currency reserves. Obviously, this puts an upward pressure on this particular pair. Also, the Swiss are actively working against the Franc, and although it isn't necessarily in this pair directly, it is hard to think that they are actions won't have at least some kind of effect on it.

Capital seems to be flowing out of the continent and into the United Kingdom currently. There are several different reasons for this, with the most obvious one being that the continent is going to be struggling to grow economically for the next few years. Adding to this is the fact that the French have elected a government that has openly stated it will increase taxes on the wealthy.

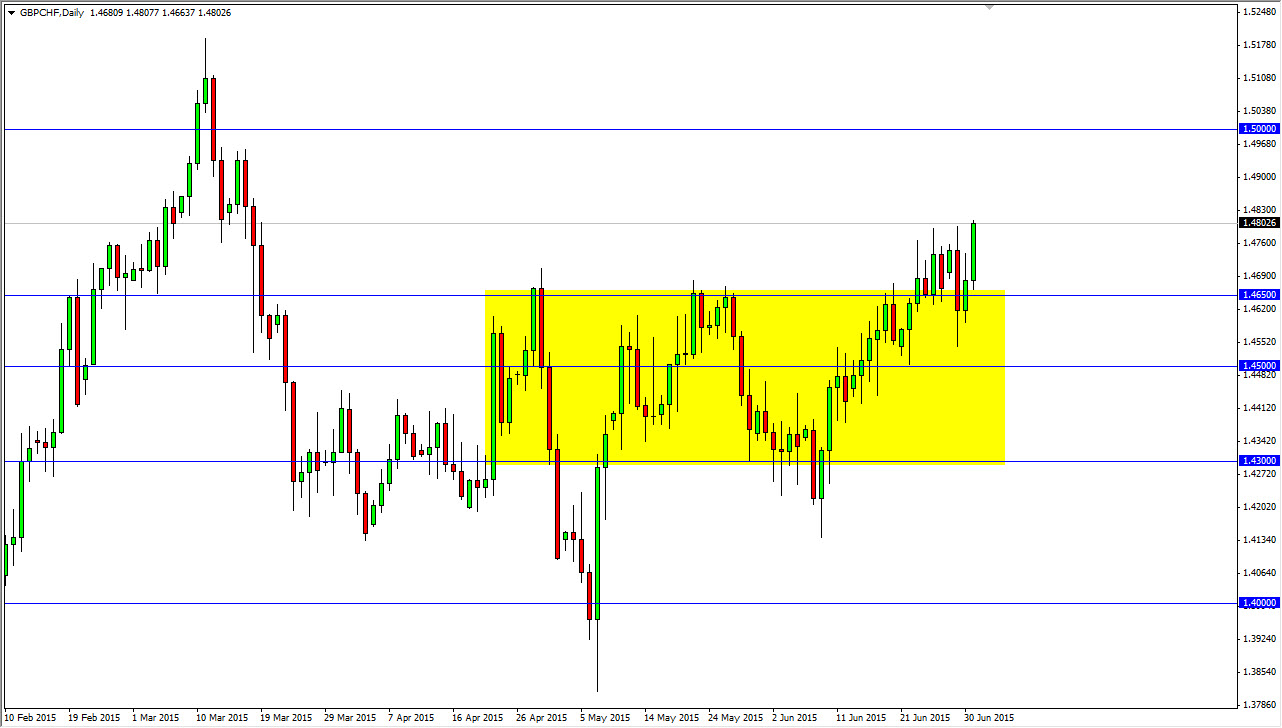

Bullish flag

A few sessions ago, I had openly stated that I was buying this pair based upon a breakout of a bullish flag. I am still longer this pair, and the pullback on Wednesday’s session will do very little to change my opinion. It is quite common for these moves to be retraced as it allows people to join in that originally missed out on the move.

The bullish flag measures for a move up to 1.58, and as such I believe that this is the opportunity to have a nice long-term trade in a market that has been rather choppy over the last couple of years. As for selling this pair, I have absolutely no interest in it and will continue to buy. Once we make a new high, I will be looking to add in small positions incrementally on the way up to the aforementioned 1.58 level.