The owners here at Dailyforex.com are fairly flexible in what they allow me to write about, but what they do expect is that I feature a lot of major pairs. However, the Forex market has far too many pairs available to traders to ignore so many of them. In fact, there are a lot of currency pairs that I watch, even though I have never actually traded them.

I have been fortunate enough to meet a lot of different traders, and from a lot of different backgrounds and work environments. There is a complete book that could be written on the subject of the myths and differences between traders, but one myth that I hear over and over is that the “big boys” (Whoever that actually is supposed to be.) won’t bother will exotic pairs. Nothing can be further from the truth, and many large trading firms and banks will even have traders that focus solely on a specific region of the world. In fact, I happen to know someone whose sole function it is to analyze and trade Scandinavian currencies. They can trade them against the Dollar, and each other. That’s it.

With this in mind, I try to educate traders to looks around. Granted, you may have trouble trading some pairs because of the pip values, spreads, or whatever. However, you can use these pairs to get a read on the economies around the world in general. In fact, this is probably even truer now than it was a few years ago now that we live in the “risk on, risk off” world.

Before you look it up….

The “PLN” tag is for the Polish Zloty. The PLN/JPY pair is about as exotic as it comes, and most brokers won’t even offer it. However, there are some things that we can look at and understand by this chart.

The PLN is a risk currency. It rises when the world feels good, much like the NZD as it is an emerging market. Think of it as the Euro on steroids in this sense. You obviously know that the Japanese yen is a “risk off” currency. Because of this, the pair rises in “good times”, and falls in “bad times.”

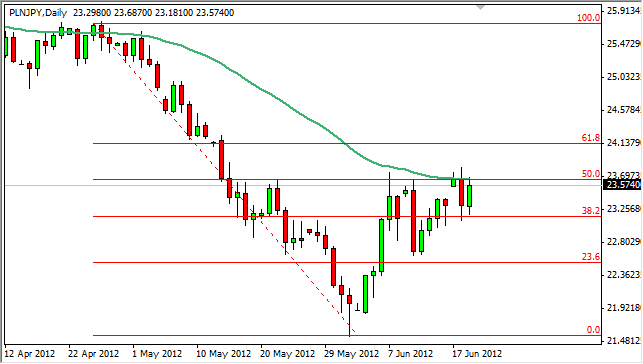

Looking at the charts, it shows that we are at the 50% Fibonacci retracement level. The 23.5-ish area looks to be resistive as a result. The 50 day exponential moving average is also acting as dynamic resistance at this point as well. This chart tells me that we are about to make a decision on the “risk on, risk off” question yet again. The Federal Reserve’s announcement later today could be the catalyst for the next move.

If the Fed chooses to ease with any significance, there is a real change of a risk rally in the Forex markets overall. If it does nothing, there is a chance that the risk appetite falls overall. By looking at this chart, you can think of it as a proxy for what the market is thinking. To me, it looks like it is thinking this announcement will drive things for a while.