EUR/USD

The most difficult pair at the moment to predict is certainly this one. The situation in Europe is only one headline away from being a disaster, and the same struggles that have hurt the value of the Euro continue. However, on Friday the US released a very weak Non-Farm Payroll report that suggests the US economy could be slowing down. This caused a bounce in the pair, but the 1.25 level remains above, and as stated previously – a negative headline can crush this pair at a moment’s notice. Because of this, the safest play is going to be to look for a rally to fade on the first signs of weakness.

.png)

AUD/USD

The AUD/USD pair fell for the week as the “risk off” scenario came over the markets. The Chinese and Americans are showing slowdowns at the moment, and as a result the commodity currencies will suffer as traders run to the Dollar. The pair seems to have found a bit of support at the 0.95 level or so, but as you can see from the weekly charts, it looks as if the pair is showing massive pressure on the support. A bounce is very likely at this point, but if more negative headlines come out, this pair falls again. Because of this, I am fading rallies, not buying them as the risk appetite out there is so poor at the moment. A daily close below the 0.95 level has me selling aggressively.

.png)

USD/CAD

The USD/CAD pair has broken out recently, and the pair continues to grind higher as the oil markets continue to fall. The demand for the CAD should continue to decline, and with it the pair will rise. A resistance area at the 1.05 level seems to be the next target, and as a result the pair is probably better bought on pullbacks. I see massive support between the 1.01 and parity levels, and will not sell until a daily close below parity. In the meantime, supportive candles after pullbacks are my cues for buying.

.png)

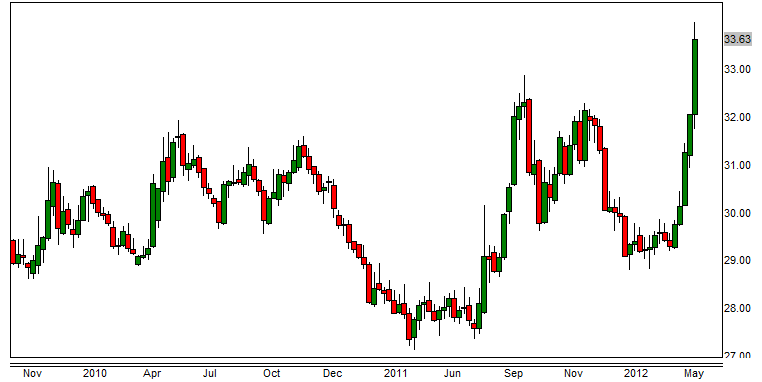

USD/RUB

Although not necessarily a major pair, the US dollar versus Russian Ruble pair is an excellent proxy for risk and oil prices globally. The pair has obviously broken out over the last few weeks, and it looks as if the pair is about to blast to the moon at this rate. This shows just how fast money is flowing out of the emerging markets, and this is a good sign that the safety trade in general should continue. So if you don’t have the ability to buy this pair on pullbacks, any of the “safety trades” should offer trading opportunities. Because of this, I feel that the fear will stay in the markets going forward. The US dollar should remain king as a result.