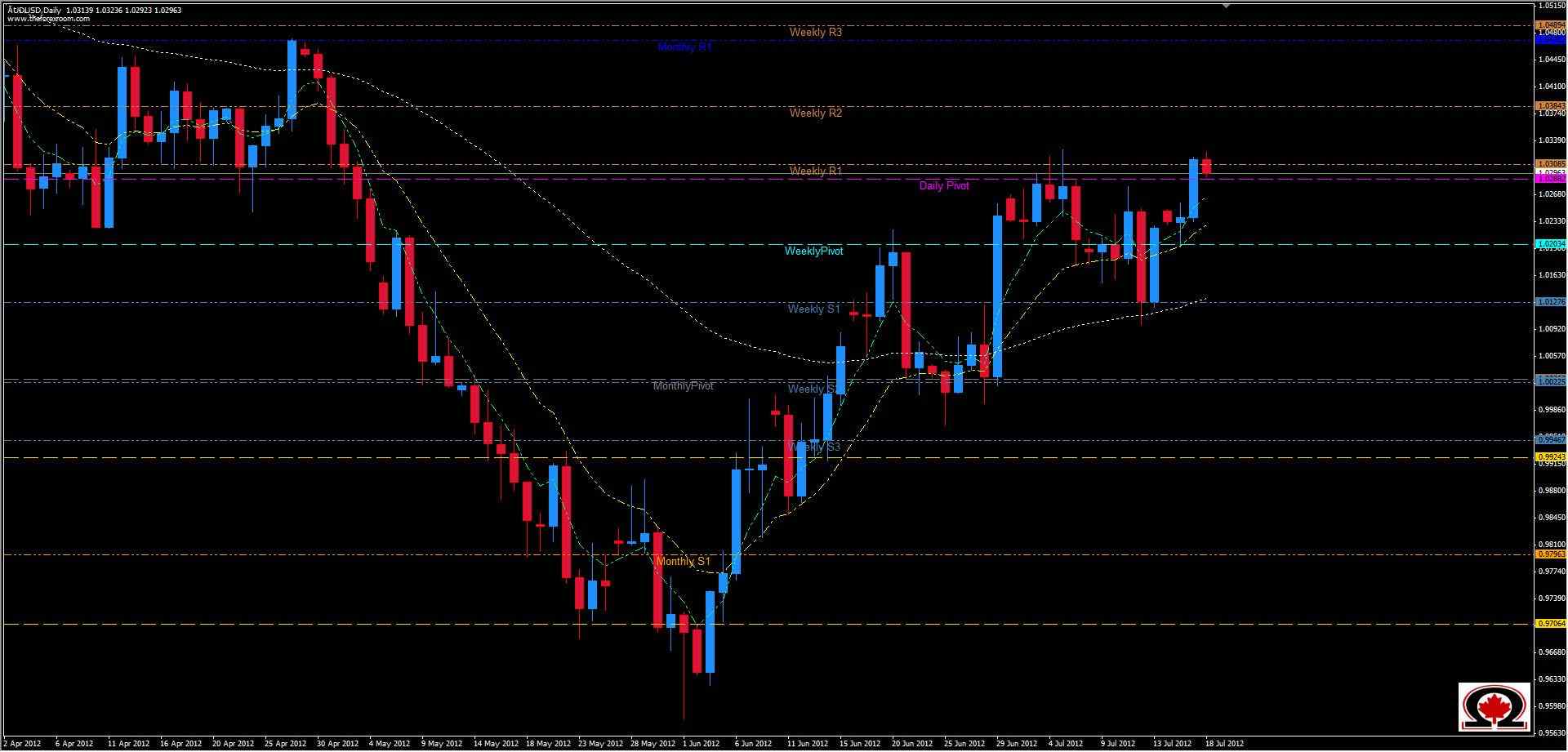

The AUD/USD pair continues to defy gravity and climbed again yesterday by another 83 pips to close above the Daily Pivot at 1.0288 but unable to break the high made on July 05 at 1.03271. The pair has hit a solid resistance zone 1.0310 with numerous trading days spent fighting to break through this level, one way or the other, in the last 2 years. There is a previous consolidation zone ranging from 1.02250 to 1.04700 that will be tough for the pair to break through, especially considering the slowing economy in China, the largest buyer of Australia's exports. With major news events set to take place in both the UK and USA later today that may weaken the USD, it is possible that this pair will keep strong & carry on. However it will be a bumpy ride and if the USD resumes its strengthening trend as of late, it will be very difficult for the AUD to claw higher. Key resistance levels are the broader levels such as the Weekly R2 @ 1.0384 & Monthly R1 @ 1.04700. Support is strong below too at 1.0203 aka the Weekly Pivot and 1.01275 where the Weekly S1 resides currently. As this pair has now made a double top with a lower high, there is some bearish sentiment here, but if the current bullish trend holds true we should see this pair climb again soon.