The AUD/USD pair saw tremendous rally during the Friday session, as the markets embrace the riskier assets globally. The move was a bit surprising, but it should be kept in mind that the Australian dollar is somewhat of a proxy for the Chinese economy. There is talk with weaker than expected numbers coming out of China overnight that the central bank in the mainland is looking to cut rates soon. This would lead to economic expansion in theory, which of course leads to buying Australian minerals and metals.

Part of the rally for the Friday session I believe was predicated upon this concept. Over the weekend we will see the Chinese central bank do something; we don't really know what at this point in time. The market is simply trying to "get ahead of" the decision on Sunday. However, the fact that the Chinese economy is slowing down is not a good sign, and I believe that the risk is still to the downside overall.

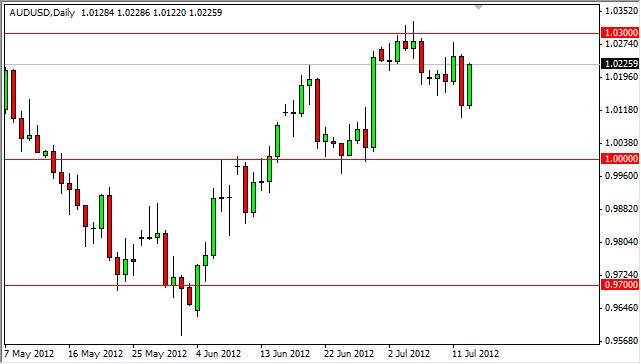

Fading rallies until 1.0350

Looking at the recent charts of the Australian dollar, it is obvious that the 1.035 level is massive resistance. Because of this, I am willing to fade this market until we break above that on a daily close. The fact that the Chinese economy is slowing down in the need to stimulate it more than likely won't provide relief for more than a short burst of time. Lately we have seen stimulus been introduced to the markets by various central banks, and it seems that the markets are expressing diminishing returns at this point in time.

The more that central banks feel the need to ease, the more likely traders are going to be nervous about what the underlying issues truly are. Any concerns out of China should tank the Aussie dollar in the long run, and as such I am looking to fade the rallies that we see at this point. On a week candle, especially right around the 1.0350 level, I am more than willing to sell this pair and ride it down to parity.