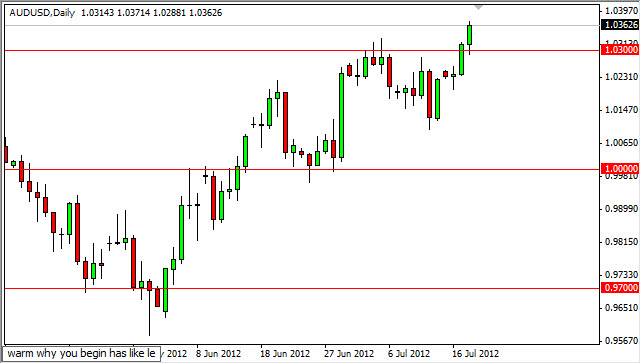

AUD/USD rose during the session on Wednesday as it appears the markets believe stimulus is coming. Whether or not they believe it is coming from the Federal Reserve, or the Chinese central bank is probably going to be relevant at the end of the day. The fact is that they believe the next "sugar high" is coming soon and as a result the commodities markets will pick up. This of course will move the Australian dollar higher, and as such this pair should continue in a bullish fashion.

The 1.03 level was significant resistance over the last couple weeks, and now minutes broken out above that area, this pair looks very strong. Recently we've seen a bit of a stutter step higher, and this looks like the next move is well. The Australian dollar of course is the most favored commodity currency in the Forex markets, and as such this is a great way to keep an eye on global risk appetite. As long as there is risk appetite out there, the commodity currencies in general should do well with a particular emphasis on the Australian dollar.

Breakout

Now that we've seen this pair move above the 1.0350 level, it is obviously broken out to the upside. The weekly chart saw a shooting star from two weeks ago just get violated during the Wednesday session, just as the two daily shooting stars were violated as well. This is an extremely strong sign for the Australian dollar, and although I do not agree with this move fundamentally, I have to admit that is impressive and it looks like we are going higher. In fact, this is a perfect example of a situation where you need to trade which you see, not what you think.

Because of the reason move, I think we're going to see a move to 1.05, and then perhaps higher honor way to 1.08 or so. Of course, the 1.05 level has to give way first before we can go that high, but it does seem apparent to me that the only direction to trade this pair at this moment in time is up. Because of this, I will be buying dips in this market.