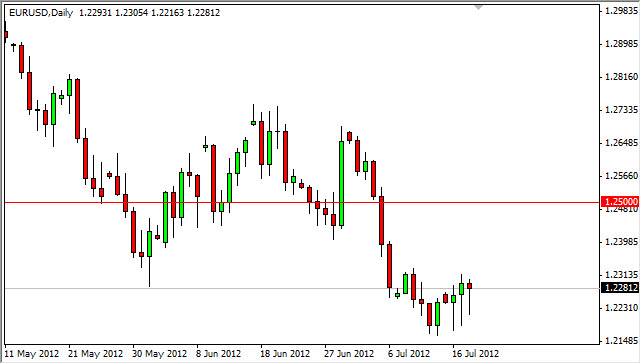

EUR/USD seems to be stuck in a pattern of déjà vu, as for the third day in a row it has fallen only to bounce back to form a hammer. This is certainly a bullish couple of sessions, and it does suggest that perhaps the 1.2150 level will offer a bit of support in this market. After all, when you look at the chart it's easy to tell that it has been and oversold market recently, and now we have to decide whether or not this area becomes consolidation, or offers a nice bounce.

Printing three daily hammers in a row is something the currency pair rarely does. Under normal circumstances, this would be very bullish and have me buying the currency pair as it shows the propensity for the market to go higher over time. However, it is my firm belief that this is simply a set up for a bounce in and oversold market. While you can certainly make money playing these bounces, it they are one of the more dangerous ways to try to profit from a currency pairs moves as the full weight of the market is working against you.

The next move

The next move will be one of two things: either a bounce from these supportive looking candles, or break down below them. From the bounce, I see move up to 1.24 or so from which you will find significant resistance. If we manage to break down below the three hammers in a row, this sets the pair up to trying the 1.2150 level for support. If that level gives, this pair goes much lower in short order.

I personally will only short this pair right now, as the European Union is has extreme issues. Even though this pair looks very supportive at the moment, fundamentally nothing has changed in Europe. All of the debt issues are still there, and the political will to do what's necessary still seems to be lacking. Because of this, I prefer to see a bounce from which to sell at higher levels. A week candle between 1.24 and 1.25 has me selling this pair without hesitation.

When you look at the longer-term charts, there was a bearish flag that suggested we were going to 1.15 before the move was said and done. I still believe that we will fall to that level, but as all things and markets are concerned, it will take time in these bounces will appear from time to time. You can rest assured that I will be shorting all of these bounces.