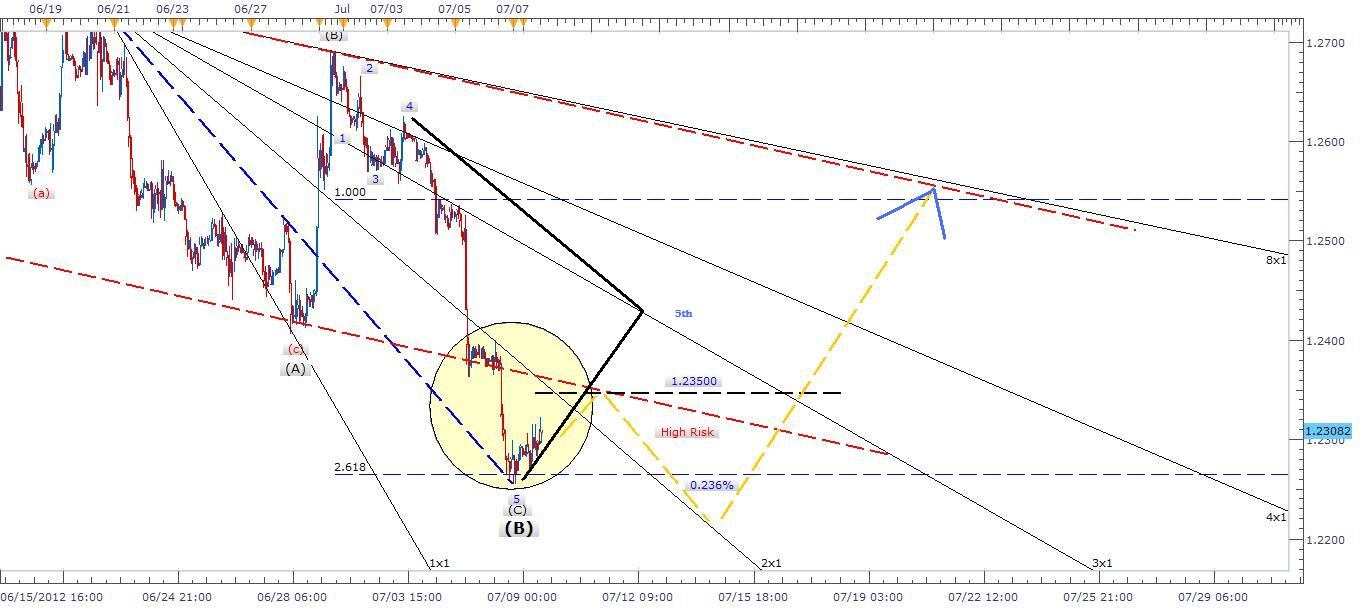

Currency: EUR/USD

Trend Expected Direction: Flat

Method: Elliott Waves and Fibonacci Levels

Description: My apology for the messy chart! However, in terms of a technical view, I see expanded fifth wave in C leg in a falling Zigzag that broke below falling channel (Red Line) reaching 2.618 Fibonacci level. In zone below the read dotted line is a very high risk area for trading although we see a positive divergence in RSI H1 (Not shown). I used Gann fan to spot falling resistance levels which they look extreme. We need to consider here the behavior of trend and expected pattern follows expanded 5th wave, which I expect an expanded flat that could follow yellow pattern (Look at Chart) hitting red line then falling below minimum level in proximate 0.236% below point (c) and then up in a motive wave that could reach 1.2600 price point. It is too early to talk about the expected target level, but I would suggest traders to keep their eyes open to buy and hold above 1.23500 level to reduce risk and increase probability. I will stay aside and post a follow up just when price move at or above 1.23500.

Recommendation: Consider buying above 1.23500