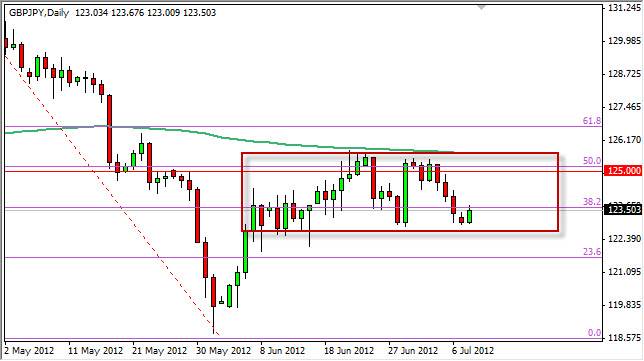

The GBP/JPY pair had a slightly bullish session on Monday in order to bounce from the bottom of the recent consolidation area. The pair looks as if it is ready to continue the sideways move, and one of the best things about this market is that I feel is so clearly defined. Unlike most of the Forex markets, this pair has an almost symmetrical pair of support and resistance levels.

This is a "risk on" currency pair. All things being equal, this pair will rise and fall with futures, stock, and it general markets globally. The bounce that we solve during the Monday session wasn't that impressive, why it should be noted that it happened exactly where we would want to see it - the 123 handle.

With the British pound getting a bit of a bit during the Monday session, it really wasn't a big surprise to see this pair rise. In general, the Yen lost value against other currencies for the session so this move makes complete sense.

Stuck in a range

The pair currently seem stuck between the 123 and 126 handles. The 200 day exponential moving averages just above the recent consolidation zone, as it is the 50% Fibonacci retracement level. Because of this I believe that this pair is ready to continue to consolidate through most of the summer. Besides, is hard to believe that there is going to be a sudden "risk on rally", until something happens in Europe of actual substance. With the low summer volumes going on currently, it is very likely that this pair will be reliable, predictable, and quite frankly boring. In other words, profitable if you are patient enough.

Currently, I have been trading this pair as it is stuck in this range and will continue to do so until it proves me wrong. In other words, I am buying at 123, selling at 126, and will do so until it no longer works. Sometimes Forex these to be simplified, and this is a great pair to see that example and right now.