GBP/USD had an absolutely astonishing day on Friday as the market shot straight up. The candle even managed to close the very top of the daily range, and as such it looks like there is still some type of energy below it looking to push prices higher. It should be stated however, that it didn't stop at the very top of a shooting star from the Wednesday session. While I believe that it will break through it, it does suggest that this may have been a little bit more along the lines of a short covering rally than a sudden newfound bullishness in the British pound.

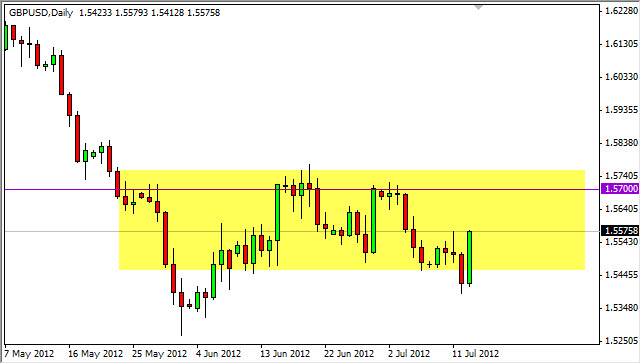

With the candle looking so strong, it makes sense that we will attempt to reach the top of the recent consolidation area. Once we broke down the 1.55 level, I admit that I thought we were going to fall at that point. Of course, false breakouts happen from time to time, and this is definitely a prime example of one. Nonetheless, I don't see any catalyst at this point is the drive this pair above the resistance level that is formed at the 1.57 and 1.58 handles.

Sideways summer grind

With the low volume during the summertime, a sideways grind is actually the more common move over this season. The last couple of years and not necessarily seeing this, so some of you out there may not be aware of this. The truth is that senior traders typically are at their desks during this time he year, and because of that the markets tend to be a little bit more thin. Because of this, summers typically will not move markets for any meaningful move.

This latest move in the British pound simply looks like it is trying to reenter the consolidation area that it had been stuck in for the last several weeks. Because of this, I believe that we will attempt the 1.57 level, but I think that we will be offered a selling opportunity at that point in time. That is actually the trade I prefer, as there is so many headline risks out there, and of course this pair is risk sensitive. I will sell a week candle once we get a little closer to 1.57 or so. In the meantime, I see that we will probably rise but more than likely will sit on the sidelines.