GBP/USD had an interesting day on Tuesday as the Federal Reserve Chairman Ben Bernanke testified in front of the U.S. Congress on the state of affairs. The initial move in this currency pair was to fall, as traders would have been betting on the Chairman giving hints that quantitative easing was just around the corner. The fact is that his opening remarks didn't mention quantitative easing at all, and this of course had the dollar bears covering their shorts as their next "sugar high" didn't look as likely as just 24 hours before when the retail sales numbers came out so poorly.

However, Mr. Bernanke did end up saying that there were a few things that the Federal Reserve could still do to stimulate the economy, and as a reaction the market started to selloff the US dollar again. Hope reigns eternal in the marketplace for stimulus, and as long as there is even a remote chance, it appears that the larger firms are more than willing to bet on it. Even though the Chairman did state that there were a handful of things that could be done if conditions warranted them, this doesn't mean that anything is going to happen. In fact, and less things get very bad for the November presidential elections in the United States, it seems unlikely that the Federal Reserve will act as it could look to be a political move, something the Federal Reserve desperately tries to avoid.

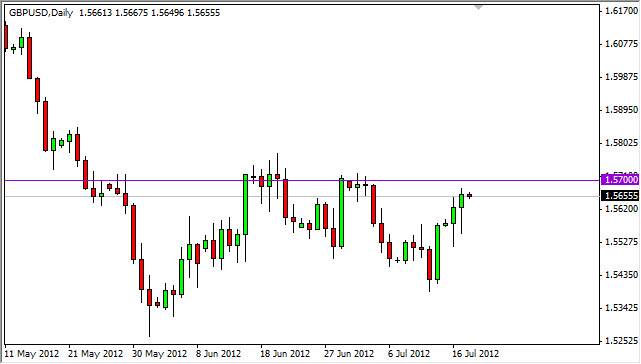

1.57

For me, the 1.57 level above is a serious resistance zone that stretches up to the 1.58 level. Granted, the daily close in this market formed a hammer, but it is pressing up against this massive resistance area. While this does look very bullish, it suggests that perhaps the market is currently trying to break out, but it still is going to have a fight on its hands.

I believe that there is a good chance that this pair breaks out to the upside; however I want to make sure that all of the stops are run above and clear down before entering to the upside. As for selling, there is still a case to be made for that if we can manage to break down below the two previous sessions, as they both formed hammers.