NZD/USD fell during the beginning of the session on Monday, but bounce later in the day once it was reported that the US retail sales numbers were weaker than expected. I don't necessarily believe that this was a run to New Zealand, rather a run from the United States. However, the Kiwi dollar is affected by commodity prices, and there is now speculation that the Federal Reserve is about to embark on further quantitative easing. This typically will push up the price of commodities, which of course pushes up the value of the Kiwi dollar.

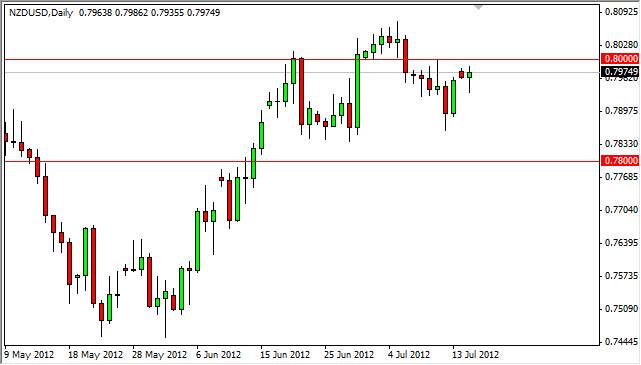

Looking at the charts, I can't help but notice that the hammer sits right on top of the Friday bullishness. This suggests to me that there were more than enough people underneath willing to step in as soon as a sell weakness. This of course is very bullish, but the Kiwi dollar will certainly have its headwinds as well.

The 0.80 and China

While the Australians are certainly known for exporting to the Chinese, the Kiwis also do as well. They export more foodstuffs to Asian countries and hard commodities like their Australian cousins, but nonetheless these movements tend to track each other. With that in mind, it must be said that the Chinese economy is slowing down, and this could have a negative effect on Asia in general. This is a headwind that the Kiwi dollar will have to contend with going forward.

Will give the charts, I see the 0.80 level as a massive resistance area. In fact, I think this area goes all the way up to 0.8050, and as such I won't be buying into we break above that level. With the Federal Reserve Chairman testifying in front of Congress today, I think that the world will be waiting to hear whether or not there is more quantitative easing coming out of the United States. If there is, this pair should break through that level above. If there isn't, I suspect that we will trade down to 0.79 first, and then 0.78 or so. If the 0.7 8 level gives way, I would become extremely aggressive on the short side of this pair. As for buying, again, above the 0.8050 level I would be very interested.