NZD/USD rose during the session on Thursday as the commodity trade grew in favor. Obviously, as the Kiwi dollar is so highly correlated to commodity markets this makes sense that the Kiwi cut a bid for the session. A lot of this is going to be predicated on the idea that the Federal Reserve is about to start easing, and possibly the Chinese central bank. However, we haven't seen any definitive answer from either central bank, so there is still significant risk for disappointment.

The Kiwi is by far one of my favorite commodity currencies to trade, simply because of two things: it's a little bit less liquid than the Australian dollar, so therefore it moves quicker. Also, it takes a little bit less margin as well, see get better bang for the buck so to speak. The spread might be slightly higher, but at the end of the day one or two pips isn't going to change the outcome of your trade.

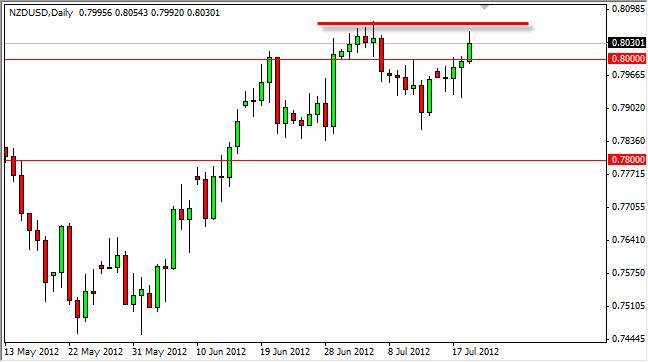

0.8050 holds

Even with the bullish action on Thursday, the Kiwi dollar could not break the crucial 0.8050 resistance level in order to get me long of this pair. The candle of course was green, broke the 0.80 level, but gave back some of the gains late in the day. While this doesn't necessarily concerned me for the bullish case, it does show that it didn't have enough strength to get above to where I want to go. This is a simple case of being patient, and waiting for the setup that you’re looking for.

Looking at this pair from a support perspective, it looks like there's a ton of it between here and the 0.78 handle. In fact, I am not going to sell this pair until we break below the 0.78 level on a daily close. So now, is just simply a matter of waiting to get my buy signal. Whether or not I get it is going to be up for debate, but the fact is that it appears overall the market is starting to take on more risk. This always bodes well for the Kiwi dollar.