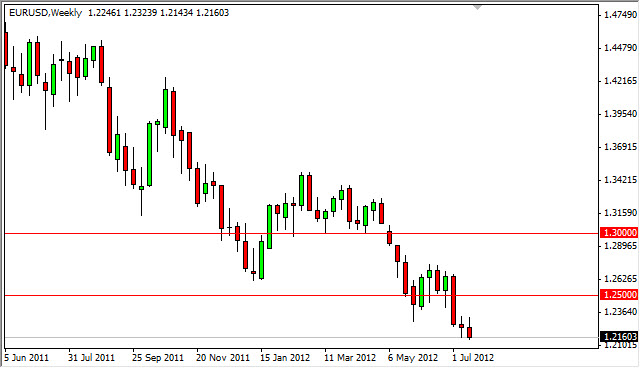

EUR/USD

The EUR/USD pair had a very volatile week over the last five sessions, only to end up closing at the very lows. Initially there were signs of serious support at this area, as the daily chart showed three hammers in a row. On Thursday, we saw a doji print, which also let me to believe that this pair was starting to find serious support. The bottom of the hammers and the general support seems to have been focused around the 1.2150 level, which is exactly the area that the massive fall on Friday has the market testing.

The European Union is in an absolute state of crisis, even if the markets tend to forget this from time to time. When the Spanish state of Valencia suggested that it would need bailed out, it became very obvious that the market suddenly found its focus squarely on Europe yet again. This is essentially what happened to the Euro during the Friday session. Is because of this that I suspect we are going much lower from here. I still maintain my eventual target of 1.15, although I think that is a long-term trade. Selling rallies is the only way to trade this market as it seems every time we rally, it's just an invitation to buy the US dollar at a cheaper rate.

USD/CHF

The Swiss franc is currently being manipulated by the Swiss National Bank; this is of course no big secret. However, this is essentially being done against the Euro and the Dollar is essentially an afterthought. This is why it's so interesting to see that the dollar is finding quite a bit of strength against the Swiss franc currently.

We are currently in an area of previous consolidation, so it of course looks like we could run into a little bit of resistance at this point. However, it is become obvious that the Dollar is the currency of choice around the world right now. Because of this, and the fact that we broke the top of the shooting star from the previous week, I believe this pair rises during the next five sessions. Expect resistance at 0.99 in the short term, but we are certainly heading towards the parity level.

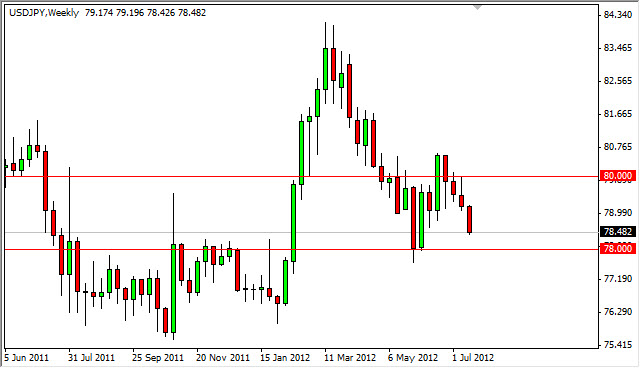

USD/JPY

USD/JPY had a very bearish five sessions as we plunged through the 79 handle. However, I see the 78 handle is a major source of support in this market, and as such I do not see much on the downside for this pair. Also, it should be noted that the Bank of Japan will more than likely get very active in this pair if we plunged below that level. As you can see from previous action late last year, there is a lot of previous support at this point. It is because of this, that I am looking to buy supportive action at the 78 handle.

CHF/JPY

While many traders do not think of the Swiss franc / Japanese yen pair as a major pair, the truth is that it features to the most major currencies in the Forex markets. The main reason I bring this currency pair to your attention is that it shows something rather remarkable. The Swiss franc is making extreme lows against the Japanese yen, showing just how weak the Franc has become. Whether or not you choose to trade this pair is a relevant, but it does bring to light the fact that one half of the equation you should be looking at of pairing the strongest currency against the weakest is already solved in many ways. We all know that the Euro is weak, but many people are totally ignoring the fact that the Swiss franc is right there with it. I believe this is because of the proximity of the two economies.