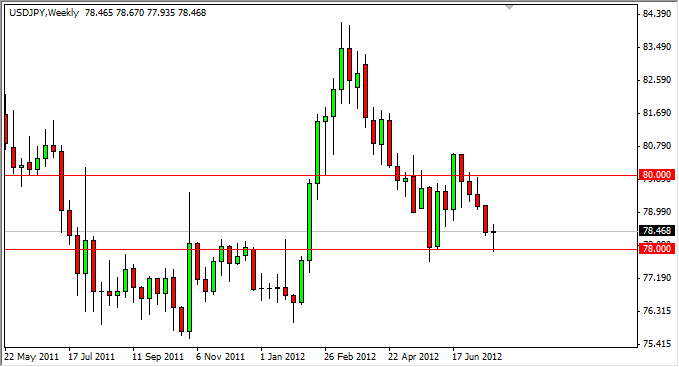

EUR/USD

The EUR/USD had an extraordinary week over the last five sessions, but failed to impress on Friday as it gave back much of its gains during the American session. The Americans are normally the biggest supporters of the Euro, and as they sold off the currency in the late hours suggests that there isn’t any real conviction in the move.

The ECB looks likely to take action, but anything it does will be akin to “printing Euros”, which of course should weaken the overall value of the currency. Because of this, my opinion on the Euro hasn’t changed, and I will be selling the break of Friday’s lows.

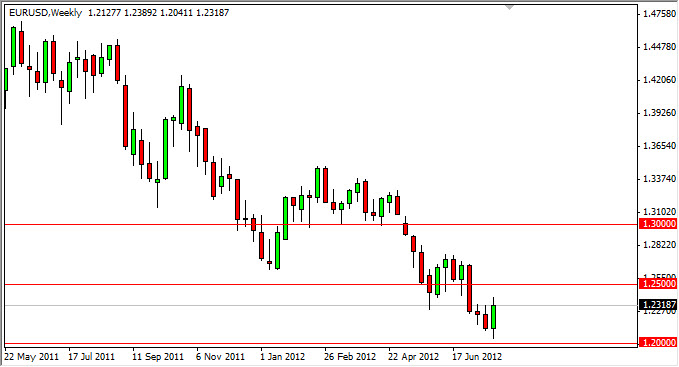

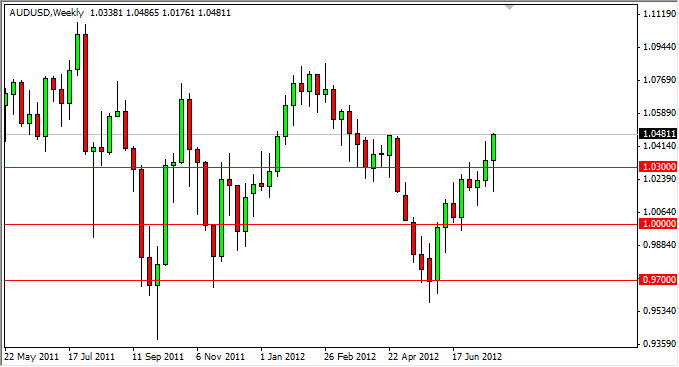

AUD/USD

On the flip side of the “risk” trade, the Aussie took off on Friday to finish the week strong. It is at the top of a recent up trending channel, and because of this I think a pullback could be coming. If this is the case, it more than likely will simply be a buying opportunity as the gold markets look strong also. With all of the easing out there, the Aussie should do well over the next several weeks if not months.

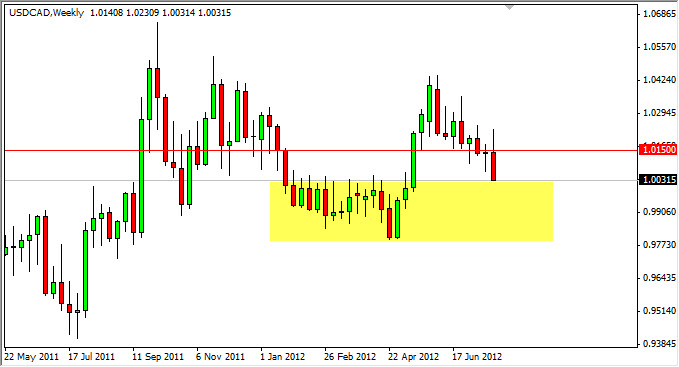

USD/CAD

The USD/CAD fell hard during the week, and even ended at the lows. However, I see the pair as sitting just on top of massive support, so selling is almost impossible at this point. The oil markets will of course be very influential in this market, and as such we need to keep an eye on oil as we trade it.

The oil markets look supportive, and as such there is a good change that it rises. If it does, this pair should fall in reaction. I still see the parity level as an area that will be necessary for the sellers to get below in order to pick up momentum, and won’t sell until we see a close below that level on the daily chart. If we do get below it, I suspect 0.97 is where we are heading at that point.

USD/JPY

I have been waiting for a sign to buy this pair for a while now. I think we have finally seen it in the form of the weekly hammer. The 78 handle looks very supportive, and the fact that this candle bounced from that particular level makes me think that there is a real chance of a bounce at this point. A break of the top of last week’s candle has me long and aiming for at least the 80 handle. If 80.60 gives way – this pair runs to 84 and possibly even higher.